Tangshan caofeidian area labor resources social security bureau

Tangshan caofeidian area education sports bureau

Announcement on open recruitment of labor dispatch personnel

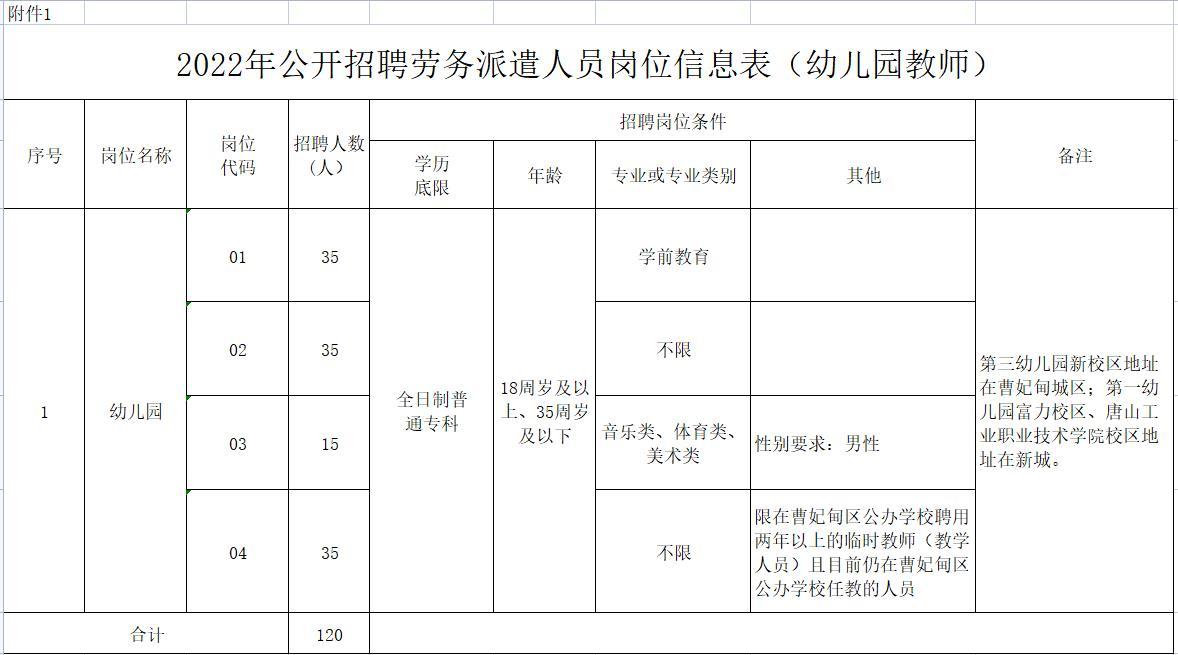

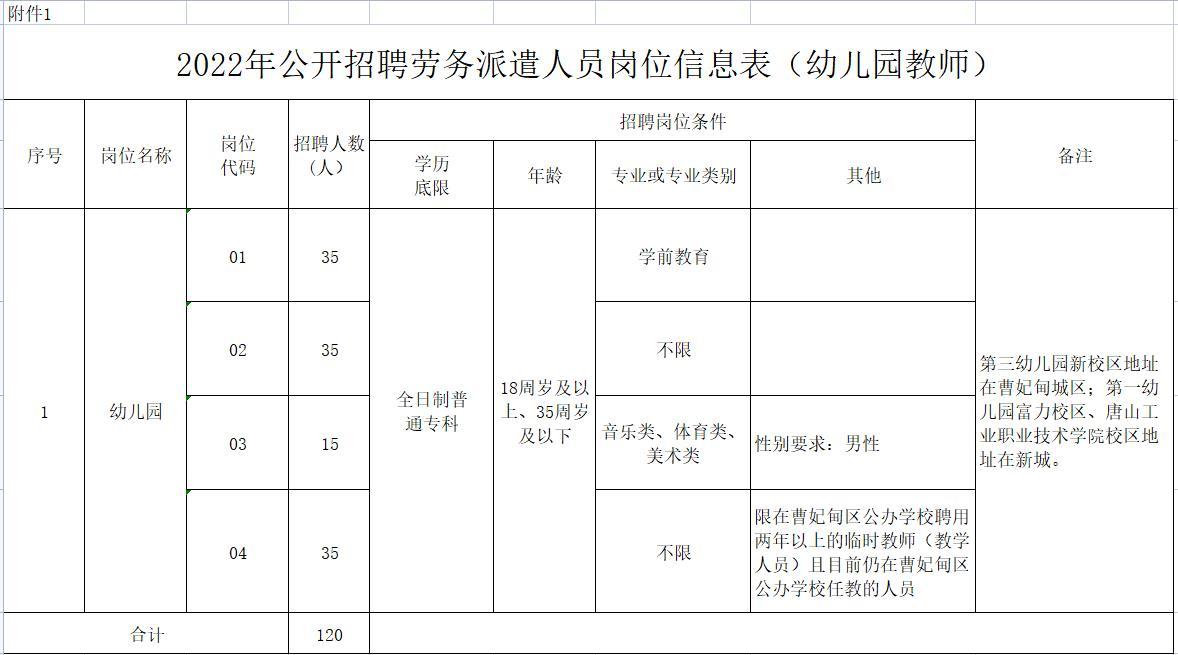

According to the needs of the work, with the approval of the district government, 120 labor dispatchers (kindergarten teachers) are openly recruited for kindergartens such as the third kindergarten new campus, the first kindergarten R&F campus and the first kindergarten Tangshan Industrial Vocational and Technical College campus under the caofeidian area Municipal Education and Sports Bureau. The relevant matters are hereby announced as follows:

First, the number of recruits

A total of 120 people were recruited this time. For details of post conditions and number, please refer to the Post Information Form of caofeidian area Education and Sports Bureau for Open Recruitment of Labor Dispatchers.

Second, the scope and conditions of recruitment

(a) candidates should meet the following basic conditions:

1. The spouse with caofeidian area household registration or married applicants is caofeidian area household registration; Temporary teachers (teaching staff) who have been employed in public schools in caofeidian area for more than two years and are still teaching in public schools in caofeidian area are not limited to household registration. The household registration is based on the location of the household registration on the first day of the announcement (August 18, 2022).

2. Age is 18 years old and above, 35 years old and below (born between August 18, 1986 and August 18, 2004).

3. College degree or above in national colleges and universities.

4. Have a teacher qualification certificate.

Regarding teacher qualification certificate: those who have not yet obtained the teacher qualification certificate can apply for the job with the qualification certificate of primary and secondary school teachers or the written test certificate within the validity period (namely, "NTCE scores of primary and secondary school teachers’ qualification examination", the qualifications of kindergarten, primary school and secondary vocational school teachers are two written test scores, and the qualifications of junior high school and high school teachers are three written test scores).

5. Abide by the Constitution and laws, have good conduct and professional ethics, have no violations of law and discipline, have no tattoos, and pass the political examination.

6. Be healthy and adapt to the physical conditions required by the post.

(two) in any of the following circumstances, shall not apply for:

1. Persons who have been detained by public security for more than administrative punishment or criminal punishment, and those who have been listed as joint disciplinary targets for dishonesty according to law;

2. Being investigated by the judicial or discipline inspection department;

3.

Laws and regulations stipulate that there are other circumstances that are not suitable for the job requirements of this position.

III. Recruitment Procedures and Methods

Recruitment takes the steps of online registration, written examination, qualification review, interview, on-site qualification review, political examination and physical examination, publicity and so on. The examination adopts a combination of written test and interview, with written test scores accounting for 40% and interview scores accounting for 60%. When calculating candidates’ scores, the method of rounding is adopted, and two decimal places are reserved.

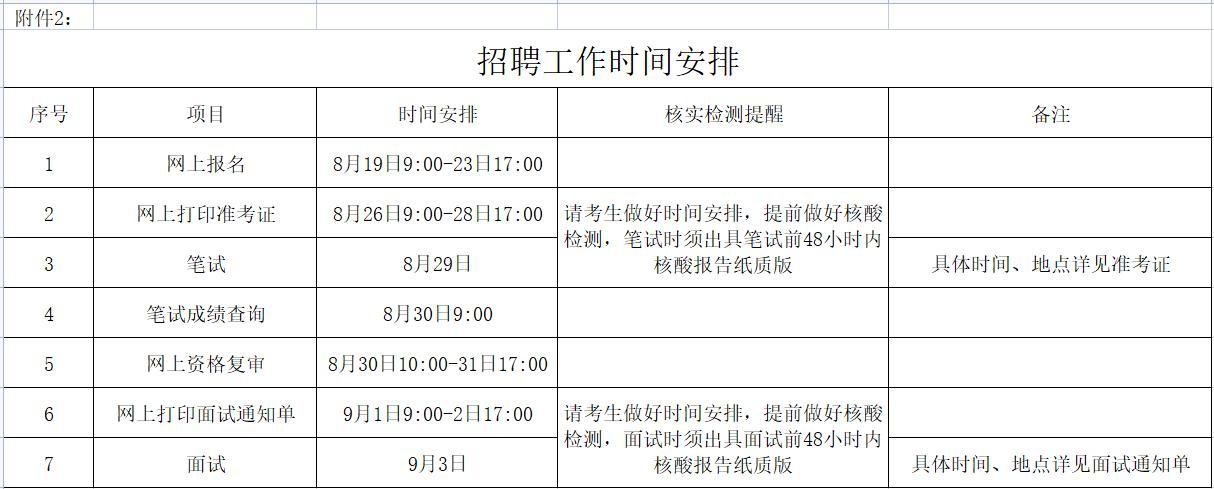

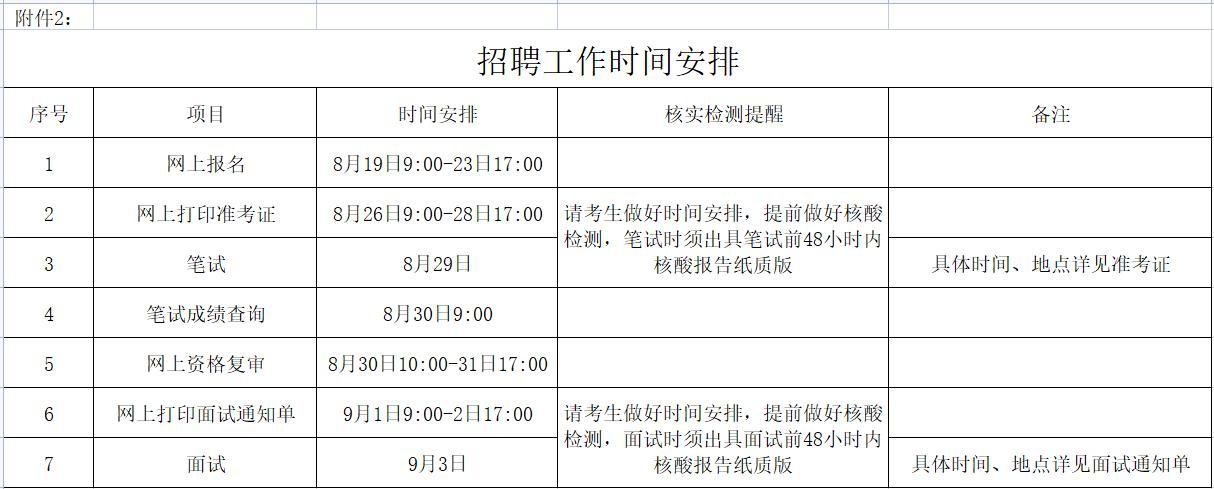

Important notices in the recruitment process will be published through Caofeidian Employment Network (www.cfdjy.cn). For the specific recruitment schedule, please refer to Recruitment Schedule.

(1) Online registration

Online registration and preliminary qualification examination are implemented in this open recruitment, and each person is limited to one position.

1. Online registration service platform: http://recruit _ sports.zxbao.com.cn.

2. Registration time: from 09:00 on August 19th to 17:00 on August 23rd, 2022.

3. Payment time: from 09:00 on August 19th to 17:00 on August 23rd, 2022.

4. Online registration procedures:

(1) Applicants should log in to the online registration service platform, register and log in, read this announcement carefully, fully understand the recruitment policy and the post conditions to be applied for, register, fill in their information in a standardized way and submit it for review.

(2) Online registration is subject to a strict self-discipline mechanism, and applicants are responsible for the authenticity of the registration information submitted for review. In any link of open recruitment (including the probation period), anyone who finds that the information reported online is inconsistent with the actual situation and does not meet the application conditions will be disqualified.

(3) The information of applicants will be locked after "submitting for review" and cannot be modified before the review results are fed back. Under normal circumstances, the auditor will reply the audit results on the registration system within 24 hours. If "Approval Failed", click "Cancel Submission" to modify the information or change the position according to the approval opinions and resubmit it for approval; "Approved"

, can not be modified, will enter the payment process. Please try not to choose the last-minute registration, so as not to miss the opportunity to change the registration because of the inconsistent application conditions or incomplete information.

(4) Please keep in mind the important time information such as the deadline for registration and payment, printing the admission ticket, written test, result inquiry, qualification review, interview and physical examination, and pay attention to relevant requirements in time. Anyone who fails to complete the relevant operations within the specified time will be regarded as giving up automatically. At the same time, you must take good care of your personal certificates and information during the registration and examination. If you lose it, steal it by others or maliciously tamper with the information for personal reasons, you will be responsible for it.

(5) online payment. The registration examination fee is 100 yuan per person (the fee will be paid after the online registration is approved, and the fee will not be refunded after the online registration fee is confirmed). The registration fee is paid through WeChat scan code, and the registration is completed if the payment is successful. Those who fail to pay the fee on time are deemed to have given up automatically.

(6) Applicants who have successfully paid the registration fee must log on to the online registration service platform from 9: 00 on August 26th, 2022 to 17:00 on August 28th, 2022 to download and print the Written Examination Admission Ticket.

Applicants are requested to keep the contact number left at the time of registration open so as to inform relevant matters.

(2) written examination

The contents of the written test are "Pre-school Pedagogy" and "A Guide to Learning and Development for Children Aged 3-6". The written test score is 100 points. The written test time is August 29th (see the written test admission ticket for details).

The written test results and whether to enter the qualification review can be inquired on the online registration service platform at 9:00 on August 30, 2022.

According to the ratio of the number of recruits to the number of qualification examiners of 1:1.5, the qualification examiners will be determined from high score to low score (the last one will enter the qualification examination together).

(3) Qualification review

This qualification review adopts online qualification review. Those who enter the qualification review must log on to the online registration service platform from 10:00 on August 30th to 17:00 on August 31st, and upload the scanned copies of the original documents and materials according to the requirements of applying for the post:

(1) Registration Form (log on to the online registration service platform to print and sign by myself);

(2) My ID card, household registration book (home page, personal page), graduation certificate, Record Form for Electronic Registration of Education Certificate of the Ministry of Education (downloaded from Xuexin.com), teacher qualification certificate or examination certificate;

(3) Married applicants who are not registered in caofeidian area need to provide their spouse’s ID card, household registration book (home page and personal page) and marriage certificate;

(4) Temporary teachers (teaching staff) who have been employed in public schools in caofeidian area for more than two years and are still teaching in public schools in caofeidian area need to provide the original certificate issued by the Education and Sports Bureau of caofeidian area.

Those who pass the examination enter the next interview procedure; Those who fail to pass the interview will be disqualified, and the responsibility for serious fraud will be investigated. Those with insufficient proportion will be replenished in turn from high score to low score according to the written test scores among the candidates who apply for the same post and above the qualified score line.

(4) Interview

The interviewer will log on to the online registration service platform to print the Interview Notice from 9: 00 on September 1st to 17:00 on September 2nd, and the interview time will be September 3rd (see the admission ticket for details).

The interview is conducted by means of skill test, including trial lecture and on-site talent show, each person has 8 minutes, including 5 minutes of trial lecture and 3 minutes of self-prepared talent show. The talent show examination room does not provide any equipment, and candidates are not allowed to bring any equipment. The interview score is 100, and the minimum qualified score is 60.

The interview results are posted at the interview test center on the same day, and you can log on to the online registration service platform for enquiry. The total score was published on Caofeidian Employment Network.

According to the order of the total score from high to low, the physical examination personnel are determined according to the ratio of 1:1 of the number of recruits, and the last test scores in the ratio are tied in the following order. Those with high academic qualifications (subject to the documents submitted for registration), those with high interview results and older people are determined.

(5) On-site qualification examination

On-site qualification examination will be conducted for those who enter the medical examination. Those who fail to pass the qualification examination will not enter the medical examination, and will be replenished according to the total test scores from high to low. The specific matters will be notified separately on Caofeidian Employment Network.

(6) Political examination and physical examination

The district education and sports bureau shall organize political examination and physical examination for the physical examination personnel, and the medical examination expenses shall be borne by themselves. If the political examination and physical examination are unqualified, the employment qualification will be cancelled, and the total score of the examination will be replenished from high to low.

(7) publicity

After the physical examination and political examination, the list of persons to be employed shall be determined according to the announcement, and publicized on Caofeidian Employment Network for five days.

(8) Selecting posts

Choose according to the order of the total score from high to low. If the total score is the same, choose according to the order of the interview score from high to low. If the interview score is the same, the selection order will be determined by drawing lots. Those who give up the post selection will be disqualified.

Fourth, the treatment

Personnel who meet the recruitment requirements after publicity shall be subject to socialized employment management, and the labor dispatch company shall sign a labor contract in a unified way. The contract period is two years, and the probation period is two months. If they are not qualified for the post during the probation period, the labor contract shall be terminated. The salary and welfare benefits shall be implemented according to the standard of labor dispatch personnel of government agencies and institutions in caofeidian area (the basic salary is 2000 yuan/month, the performance salary is 500 yuan/month, and five insurances and one gold are paid).

V. Strengthening leadership

In order to strengthen the leadership of recruitment, the caofeidian area Municipal Education and Sports Bureau has set up a leading group for the open recruitment of labor dispatch personnel, which is responsible for the organization and coordination of open recruitment to ensure that the recruitment work is open, fair and just.

Six, the applicant epidemic prevention and safety instructions

1. In order to ensure the life safety and physical health of the candidates and examination staff, and ensure the safety of open recruitment, candidates must hold the Personal Health Information Commitment Letter and other links such as written examination, interview, on-site qualification examination and physical examination.

The paper version of the nucleic acid test report within 48 hours can only be attended if the body temperature is normal after on-site measurement.

2 "Hebei health code" is a red code or a yellow code, and no one is allowed to take any part of the exam.

3. According to the relevant regulations on epidemic prevention and control, candidates must declare their health status 14 days before the exam. Log on to Caofeidian Employment Network to download and fill in the Personal Health Information Commitment Letter.

》。 Applicants shall implement a commitment system for reporting personal health status, and promise that the reporting content is true, accurate and complete. Anyone who conceals, omits or lies about the history of residence, contact history, health status and other key information on epidemic prevention and control shall be recorded in the examination integrity file and dealt with according to the rules and regulations.

4. After the announcement, if there are new requirements and regulations for epidemic prevention and control work, it will be notified separately through Caofeidian Employment Network, and applicants are requested to pay attention in time.

Recruitment consultation telephone: 0315-8727705

Special note:

The examination does not specify a book for examination counseling, nor does it hold or entrust any institution or individual to hold an examination counseling training class.

August 18, 2022