Blockchains have become a new "painted skin" of deception, and these blockchains are all scams.

The late car cost is the focus of its potential consumers. Next, let’s take a look with Xiaobian.

Let’s take a look at the appearance of Passat plug-in hybrid. Passat plug-in hybrid front face presents an elegant design style, which makes people unforgettable. Then the young and fashionable headlight design is adopted, which can win the love of young people. The car is equipped with LED daytime running lights, automatic opening and closing, adaptive far and near light, automatic steering, delayed closing, rain and fog mode and so on. Coming to the side of the car body, the size of the car body is 4948 mm * 1836 mm * 1469 mm. The car adopts fashionable and simple lines, and the side gives people a very fashionable and generous feeling. With large-size thick-walled tires, the shape is eye-catching. Looking back, the rear of the car looks more dynamic and lively, and the taillights look very fashionable and simple, with a sense of neatness.

Sitting in the car, Passat plug-in hybrid interior enhances the visual angularity, which is very in line with the tastes of young consumers. The steering wheel of the car is very in line with the interior style, made of genuine leather, and the visual effect is good. From the central control point of view, the design of the center console is reasonable, which makes the interior style impressive and looks very dynamic and lively. Let’s take a look at the dashboard and seats again. The dashboard of the car presents a simple design style, and the sports atmosphere is in place. The car uses leather seats, equipped with auxiliary seat electric adjustment, seat with memory electric adjustment, seat proportion down and other functions, and the overall comfort is acceptable.

The car is equipped with driving mode selection, remote control key, interior atmosphere light, engine start and stop, traction control (ASR/TCS, etc.) and other configurations, which are rich in functions and greatly enhance its convenience of use.

OK! Next, let’s sum up. This car has been introduced almost before, and I believe many users who buy a car have taken a fancy to its comfort and practicality.

CCTV News:Today (October 5th) is the 7th day of Mid-Autumn Festival and National Day holiday.Multi-station ushered in the peak of return passenger flow. The national railway is expected to send 17.95 million passengers today, and 12,351 passenger trains are planned, including 1,729 additional trains. China State Railway Group Co.,Ltd. has increased its transportation capacity in Beijing-Shanghai, Chengdu-Xi ‘an, Nanning-Guangzhou, Shenyang-Beijing, Hong Kong-Shenzhen and other popular directions.

The peak of return trip in Taiyuan, Shanxi Province shows that more trains are added to ensure passengers’ smooth travel.

At the entrance of Taiyuan South Station, the passenger peak of Taiyuan South Station is from 9: 00 am to 11: 00 am and from 2: 00 pm to 4: 00 pm every day. During the peak period, a total of 15 security checkpoints at the east and west entrances of Taiyuan South Station are all enabled. According to the latest data of Taiyuan Railway Department, Taiyuan Railway Station and Taiyuan South Railway Station are expected to send 155,000 passengers and arrive at 130,000 passengers today. Most of the passengers sent and arrived today are long-distance trans-provinces. Due to the highly overlapping of family visits, student flows and tourist flows, the current peak of return trip has initially appeared. In order to allow more passengers to travel smoothly, Taiyuan Railway has also added 32 high-speed EMUs and 11 ordinary-speed trains from Taiyuan to Beijing, Tianjin and Xi ‘an, and increased the number of EMUs reconnected by 28.

In particular, it is necessary to remind the outbound passengers that when taking the train reconnected by the EMU, they must be optimistic about their car position, because the EMU reconnection adopts the "8+8" grouping mode, and the front and back of the two trains with eight cars are not connected with each other. If you get on the wrong car, please prepare your luggage in advance and move to the adjacent car at the connection. When the train arrives at the midway stop, you can quickly move to the designated car.

Harbin Station in Heilongjiang Province is carefully deployed to serve passengers’ travel.

Today, it is estimated that there will be more than 80,000 passengers in Harbin Station. The main direction of travel is through Beijing, Shanghai, Qingdao, Hangzhou, Wuhan, Guangzhou and other directions, and the direction of Jilin, which is close to the province, has been sold out.

In order to cope with the peak passenger flow, Harbin Railway Station has taken some new measures. In terms of security inspection, the security inspection channels in the north and south directions are kept normal and open 5-mdash; 7 channels, all 9 channels are open during the festival. At the same time, the "three-zone operation method" of pre-inspection area, waiting inspection area and security inspection area was adopted to avoid the backlog of passengers by zoning buffer. The second is ticket checking. Under the condition that the gap between adjacent ticket gates is sufficient, large passenger trains have implemented split-screen synchronous ticket checking to effectively ensure the speed of passengers entering the station.

Today, the Harbin Bureau of China Railway is expected to send nearly 400,000 passengers throughout the day, and the Beijing-Harbin high-speed railway will continue to open night EMUs, striving to meet the requirement of running at least one train from Harbin to Beijing every hour from 3 am to 23 pm. In view of the characteristics that all cities in the province will take Harbin as the hub for transit, the railway department has opened 44 short-distance EMUs in the province on the peak line to fully meet the short-distance and transfer needs of passengers.

Shanghai added more trains and subways, delayed many measures to deal with the return peak.

From 10: 00 this morning, shanghai hongqiao railway station began to usher in the peak of return passenger flow, with an average of every 5— A train leaves or arrives in six minutes.

According to the latest data provided by the railway department, today, the number of passengers arriving at the Shanghai Railway Station is expected to reach 610,000. To this end, the railway department has increased the capacity of key time periods and popular directions, and added 399 passenger trains from Shanghai to Xi’ an, Wuhan, Changsha and other directions, as well as popular tourist cities in the Yangtze River Delta region. At the same time, the EMU trains were reconnected, and the number of carriages of 249 EMU trains was increased from 8 to 16, and 140 ordinary trains were added to meet the travel needs of different passengers.

In order to cope with the large passenger flow of the railway, shanghai metro line 2, Line 10 and Line 17 have further added fixed-point overtime trains on the basis of the established delay and opening plan. On the night of October 5-6, the latest departure time of the designated overtime trains at Hongqiao Railway Station was extended, from Line 2 to 2: 00 the next day, Line 10 to 0: 30 the next day, and Line 17 to 0: 00 the next day.

According to the latest data, the return peak will last until the night of the 6th, when there will be some traffic congestion in Shanghai, reminding passengers to arrange their trips in advance.

Text/Zhang Xing Deputy Director Pharmacist of zhongwei People’s Hospital of Ningxia Hui Autonomous Region

Pumpkin seeds, also known as pumpkin kernel, white melon seeds and golden melon rice, are the seeds of cucurbitaceae pumpkin and are widely cultivated all over the country.

Pumpkin seeds are slightly fragrant and slightly sweet. It is better to have large seeds, full kernels, yellow-white shells and fresh ones, and grind them into powder for raw use.

Natural "insect repellent"

Pumpkin seeds can repel insects and paralyze the middle and rear segments of beef tapeworm or pork tapeworm. Pumpkin seeds can significantly reduce the growth rate of Schistosoma japonicum larvae, and are mainly used to treat diseases caused by tapeworms, roundworms, hookworms, pinworms, schistosomiasis and other parasites.

In addition, pumpkin seeds can also induce diuresis to reduce swelling and promote lactation, and can be used for postpartum hypogalactia’s disease, diabetes, prostatic hypertrophy, edema of hands and feet, whooping cough and hemorrhoids.

This way, the curative effect is better. 01 expel beef tapeworm

Can be chewed with pumpkin seeds (stir-fried, shelled), or decocted with betel nut slices in water.

Eating pumpkin seeds on an empty stomach in the morning, taking areca nut decoction 30 minutes later, and drinking water with magnesium sulfate 2 hours later, the effect of expelling tapeworms is better.

02 expel ascaris

When treating ascariasis, pumpkin seeds can be ground (shelled and preserved), added with boiled water, honey or white sugar, mixed into paste and taken on an empty stomach. You can also fry pumpkin seeds and take them on an empty stomach. Stir-frying pumpkin seeds, grinding into powder, adding white sugar and boiling water, and can also be used for schistosomiasis.

03 Postpartum swelling of hands, feet and breasts

You can fry pumpkin seeds and add water to fry them. For postpartum hypogalactia, you can grind pumpkin seeds, add brown sugar and boiled water, and take them on an empty stomach in the morning and evening.

04 malnutrition

You can grind pumpkin seeds, peanut kernels and walnut kernels and take them in the morning and evening. Half a month is a course of treatment.

05 chronic prostatitis

You can chew a proper amount of sun-dried fresh pumpkin seeds every day (peeled, about 30 grams) and press Guanyuan point at the same time, which can effectively relieve the disease.

Chronic leg ulcer

Mash pumpkin seeds preserved for more than 2 years and apply them around the ulcer surface; Taking fresh purslane, mashing it into mud and applying it on the ulcer surface can effectively relieve the symptoms of ulcer.

07 whooping cough

After grinding, mix with brown sugar.

Note: Although pumpkin seeds are sweet, non-toxic and kill insects without harming vital qi, excessive consumption may lead to dizziness; Patients with stomach heat should eat less to prevent overeating from causing stagnation of qi and abdominal distension; People with qi stagnation should also be cautious.

poster;playbill

1905 movie network news Since its release on July 26th, Ne Zha has formed a movie-watching craze in the summer, and the box office has exceeded 4.3 billion yuan, ranking third in the box office of China film history, creating a new box office record for animated films and achieving good social and economic benefits.

On August 23rd, the National Film Bureau organized a seminar on animated films in Ne Zha, where experts and Ne Zha’s creative team summarized the successful experience and creative rules of the film and explored effective ways to promote the prosperity and development of China’s animated films.

Tell the "China Story" Realize the creative transformation and innovative development of Chinese excellent traditional culture

Experts attending the meeting believed that the success of "Nezha" in box office and word of mouth proved the inexhaustible vitality of Chinese excellent traditional culture, provided rich cultural resources for the creation of "China Story", boosted the audience’s confidence in domestic animation, found new highlights and growth points for the development of China films, and was a good film in the new era to enhance national self-confidence. Nezha, through the creative adaptation of the characters and stories in China’s classic myths and legends, carries forward and reshapes the excellent Chinese traditional culture, which meets the needs of contemporary society and young audiences. The theme of "My life is up to me, not the sky" can also resonate with audiences of all ages and truly realize the animated film "family fun".

Yin Hong, a professor in Tsinghua University, suggested that Nezha captured the common theme of cartoons all over the world — — "Growing up" combines Nezha’s mental journey with the growing needs of teenagers at present, realizing the possibility of dialogue between traditional heroes and the present. Jia Xiuqing, deputy director of the Art Department of China Communication University, thinks that "Nezha" and "Mrs. Yin" correspond to the popular "Xiong Haizi" and "Tiger Mother" respectively, and build a bridge between traditional classics and modern audiences.

Nezha’s aesthetic style with China characteristics reflected in the characters, performances and scene design also left a deep impression on experts. Scholars believe that the success of "Nezha" lies in that while absorbing the nutrition of Hollywood and Japanese animation, it has found its own way, using the most advanced film techniques and expressions to create China stories, and integrating China characteristics into world animation, which not only enhances national self-confidence, but also conforms to the development trend of globalization.

Li Jianping, dean of the Animation School of Beijing Film Academy, said that the rise of a number of "national romances" such as "Nezha" has enhanced the cultural self-confidence of animation students, "turning the worship of foreign animation into concern for domestic animation has played a positive role in the growth of self-confidence and the direction of creation."

Improve the industrialization level of the industry Vigorously promote the overall development of animation film industry

As representatives of the first-line creators, the main creators, including Wang Changtian, the producer of Nezha, the chairman of Light Film, and jiaozi, the screenwriter and director of Nezha, said on the spot that they can highlight the great attention and cordial concern of the CPC Central Committee and Publicity Department of the Communist Party of China for the animated film industry in recent years, and the National Film Bureau has given the animated film industry unprecedented support in terms of funds, talents and publicity. In terms of funds, the support policies are very effective. Every year, animated films with excellent social and economic benefits receive direct support from the special funds for film quality and the China classic folk story animated film creation project. In terms of talent training, some excellent animation directors, screenwriters and producers like jiaozi will also go to the world’s excellent film production institutions for exchange and study through the regular arrangement of the Film Bureau.

Wang Changtian also revealed at the seminar that Guangming will continue to increase investment in animated films in the future and adhere to the strategy of "grasping fine products, exploring new ways and educating new people". Many animated films such as Big Fish Begonia 2, Deep Sea and Journey to the West will meet the audience one after another.

Wang Changtian, Chairman of Light Film.

When talking about the hope for the domestic animated film market, jiaozi, director of Nezha, said: "I hope that more outstanding works will emerge in the future. Each work is a star, and gradually the stars will gather into a starry sky, illuminating the whole industry."

Director jiaozi.

While recognizing the achievements made by Nezha and China Animation, the experts attending the meeting also pointed out that the whole industry still faces some problems, such as insufficient quality products, insufficient height and weak creative team strength, and there is still a big gap compared with the 15%-20% box office share of animated films in developed countries. China animation should take "Nezha" as an opportunity to continuously improve the overall industrialization level of the industry and gradually form a brand effect.

The State Film Bureau said that it will further increase the support for animated films in terms of policies, funds and talents, continue to do a good job in the production of fine animated films, and strengthen publicity and criticism. At the same time, it is hoped that the creators of animated films can better enhance the cultural connotation of animated films, inherit and carry forward Chinese excellent traditional culture, inherit Chinese cultural genes, and show Chinese aesthetic style. We should run the spirit of innovation through the whole process of film creation, enhance originality, draw nutrition from rich historical and cultural resources such as fairy tales, innovate the content and form of animated films, and truly achieve creative transformation and innovative development of Chinese excellent traditional culture. It is necessary to improve the storytelling ability, tell China’s story well through animation, truly "show humanity" and "move people’s feelings", and push China’s animated films to the world.

The General Office of the People’s Government of Guangdong Province issued a document on accelerating the promotion of science and technology

Deep financial integration helps the innovation and development of science and technology enterprises

Notice of implementation opinions

Guangdong government office [2024] No.2

People’s governments at the local and municipal levels, departments and institutions directly under the provincial government:

"Implementation Opinions on Accelerating the Deep Integration of technology and finance to Help the Innovation and Development of Science and Technology Enterprises" has been agreed by the provincial people’s government and is hereby issued to you, please implement it carefully. Problems encountered in the implementation process, please report to the Provincial Science and Technology Department and the Provincial Finance Office.

General Office of Guangdong Provincial People’s Government

February 9, 2024

On accelerating the deep integration of technology and finance

Implementation opinions on assisting the innovation and development of science and technology enterprises

In order to fully implement the spirit of the important speech delivered by the 20th Party Congress and the Supreme Leader General Secretary at the Central Financial Work Conference, accelerate the deep integration of science and technology and finance, help the innovative development of science and technology enterprises, and further improve the whole process of innovation chain, we hereby put forward the following opinions:

First, promote venture capital institutions to invest in early investment, small investment and hard technology

Promote the coordinated development of various government investment funds at the provincial, municipal and county levels (cities, districts), and guide social capital to invest more in key technical fields and start-up technology-based enterprises in our province. Encourage social capital to unite with national and provincial laboratories, national technology innovation centers, universities, scientific research institutes, manufacturing innovation centers, science parks, leading enterprises in the industry and specialized small and medium-sized enterprises, etc., and support original core technologies, cutting-edge disruptive technological breakthroughs and transformation into real productivity with the mode of "public welfare funding+equity investment". Support the cultivation and establishment of proof-of-concept funds. Establish and improve the investment decision-making, performance appraisal, market-oriented selection and employment, employee incentives, fault tolerance and exemption systems of state-owned venture capital institutions, and promote them to better play the key role of early investment, small investment and hard technology. Optimize the performance evaluation methods of government investment funds in the field of innovation and entrepreneurship, implement differentiated classification assessment, pay attention to the overall efficiency evaluation, and do not take the preservation and appreciation of state-owned capital as the main assessment goal. The provincial science and technology projects will give some subsidies to venture capital institutions that invest in science and technology enterprises in the seed stage and start-up stage of the province according to their actual investment. Support social capital to set up angel investment funds. Actively cultivate organizations such as joint social groups that support members and serve angel investors, and cultivate and expand angel investor groups.

Second, attract venture capital institutions and high-end talents to develop in Guangdong.

Encourage qualified cities to give appropriate subsidies to newly registered local venture capital institutions and their senior managers according to certain conditions, and attract domestic and foreign venture capital institutions and venture capital talents to settle in Guangdong. Intensify efforts to introduce high-end talents for venture capital, and eligible talents will enjoy relevant preferential policies according to regulations. Strengthen the propaganda and practical guidance of preferential tax policies for venture capital. Strive for state support and give priority to the implementation of differentiated tax rates and other preferential tax policies to encourage venture capital enterprises to invest for a long time in Guangdong.

Third, broaden the sources of venture capital funds and exit channels

Under the premise of compliance with laws and regulations, controllable risks and sustainable business, subsidiaries with investment functions, financial subsidiaries, securities companies, insurance institutions and trust companies of commercial banks are supported to provide long-term financial support for venture capital through capital contribution or development of corresponding long-term investment products. Support qualified enterprises to issue corporate credit bonds for venture capital according to laws and regulations, and encourage government financing guarantee institutions to provide credit enhancement support for venture capital enterprises to issue bonds for scientific and technological innovation. Encourage social capital to set up private equity secondary market funds (S funds) according to laws and regulations, support Guangdong regional equity market to carry out pilot equity investment and venture capital fund share transfer, and smooth the exit channels of venture capital.

Four, guide the banking financial institutions to expand the scale of science and technology credit

Give full play to the incentive role of monetary policy tools such as refinancing, encourage banking financial institutions to incorporate service technology innovation into strategic planning, and strive to achieve the year-on-year growth rate of loans for science and technology enterprises not less than that of various loans during the 14 th Five-Year Plan period, and the number of borrowers not less than the same period of last year. Guide development and policy-oriented financial institutions to provide more long-term and low-cost financial support for the construction of major scientific and technological innovation platforms that meet the requirements within the scope of business and under the premise of controllable risks, and form a joint force with financial guidance investment funds. Encourage banking financial institutions to accelerate the development of life-cycle financial services for technology-based enterprises around the talent chain of innovation chain industrial chain. On the basis of risk prevention and control, we will increase credit loans for science and technology enterprises in the initial stage, strive to improve the "first loan rate" of science and technology enterprises, and standardize the development of "science and technology talent loans". We will increase project loans for science and technology enterprises in the growth period to meet the needs of expanding production, and standardize supply chain finance, intellectual property pledge loans and other businesses. Strengthen comprehensive financial services for mature technology-based enterprises, and encourage market-oriented mergers and acquisitions of enterprises through M&A loans. Under the premise of risk control, support banking institutions to increase R&D loan support for science and technology enterprises, and reasonably determine the loan method, amount and term. Encourage the development characteristics of science and technology enterprises, make full use of the policy of non-repayment of loans, and adopt more flexible interest rate pricing and interest repayment methods to effectively meet the financing needs of different types of science and technology enterprises under the premise of legal compliance and risk control. Conditional cities can arrange emergency lending funds for small and medium-sized science and technology enterprises.Provide short-term capital turnover support for small and medium-sized science and technology enterprises.

Five, improve the differentiated science and technology credit management and assessment mechanism.

Promote enterprise innovation points system, promote the establishment of information sharing mechanism for enterprise innovation ability evaluation, encourage banking financial institutions to establish an exclusive evaluation system for financing of science and technology enterprises with enterprise innovation ability as the core indicator, implement differentiated credit approval mechanism, and enhance the credit capacity of small and micro-sized and start-up science and technology enterprises. Encourage banking financial institutions to establish a relatively independent centralized technology and finance business management mechanism, and strengthen the front, middle and back office collaboration. Encourage the standardized construction of specialized or characteristic branches in technology and finance, establish professional teams, specialized wind control systems, special incentive assessment mechanisms and credit standards for exclusive customers, and appropriately delegate credit approval and product innovation authority. Support banking institutions to list the loan scale of science and technology enterprises separately, and adjust and optimize the economic capital occupation coefficient. Banking financial institutions are encouraged to implement technology and finance’s due diligence exemption system in detail and establish a negative list of due diligence exemption. Explore the overall assessment of scientific and technological innovation loans on a periodic and batch basis, effectively increase the proportion of technology and finance’s relevant indicators in the internal performance assessment of institutions, and implement the policy requirements of appropriately improving the tolerance of non-performing loans of scientific and technological enterprises. The tolerance of non-performing loans of small and micro-scientific and technological enterprises can be increased by no more than 3 percentage points compared with the non-performing loan rate.

Six, improve the risk sharing and compensation mechanism of science and technology credit.

Promote government financing guarantee institutions to improve their business models, build a risk sharing mechanism with banking financial institutions, and expand the scale and coverage of loans for small and micro science and technology enterprises. Strengthen the linkage mechanism between provinces and cities for risk sharing and compensation of science and technology credit, and encourage qualified cities to increase investment in science and technology credit risk compensation funds. Improve the management system of risk compensation for science and technology credit, adjust and optimize the loan risk sharing ratio and compensation standard according to the innovation ability of science and technology enterprises and the development characteristics of different life cycles, improve the efficiency of loan loss review and bad debt loss compensation, and establish a performance evaluation system that conforms to the law of the use of risk compensation for science and technology credit. Support the inclusion of scientific and technological credit products such as "scientific and technological talents loan" and "scientific and technological achievements transformation loan" in the scope of risk compensation.

Seven, promote the financing of intellectual property pledge to improve quality and efficiency.

Increase the promotion and application of recommended national standards such as the Patent Evaluation Guidelines, and support qualified banks to explore and carry out internal evaluation of intellectual property rights. Actively carry out pilot online registration of intellectual property pledge, improve supporting services such as intellectual property evaluation, registration and management, guide banking financial institutions to optimize intellectual property pledge loan products and service models according to the characteristics of technology-based enterprises, and expand the scale of intellectual property pledge financing business. Improve the support policies for intellectual property pledge financing, optimize the operation process of intellectual property pledge financing risk compensation fund, and expand the coverage of support policies and compensation funds. Optimize the disposal mode of intellectual property rights, recommend professional intellectual property operating institutions or platforms, support banking financial institutions to hand over intellectual property rights to operating institutions for centralized operation and disposal by means of entrustment and centralized storage, and broaden the channels for intellectual property rights circulation, trading and liquidation.

Eight, strengthen the support of multi-level capital market for science and technology enterprises.

We will implement the step-by-step cultivation plan for listed reserve high-tech enterprises, guide high-quality high-tech enterprises to make reasonable listing plans, and seize the opportunity of registration system reform to raise funds for listing. We will promote local cities to improve the subsidy policies for the listing of science and technology enterprises, and focus on supporting the listing and financing of high-quality enterprises that meet the national and provincial strategic needs and break through key core technologies. Encourage listed technology-based enterprises to raise funds by issuing stocks or convertible bonds, and carry out mergers and acquisitions focusing on "strengthening the chain, extending the chain and supplementing the chain" in the industrial chain. Support and promote the Shanghai, Shenzhen and Beijing stock exchanges and professional securities service institutions to set up service bases and workstations in qualified cities or establish a designated contact system to provide accurate services for science and technology enterprises. Improve the efficiency of service technology innovation in Guangdong’s regional equity market, continuously enrich service tools and financing products, and promote the efficient operation of "specialized, special and new boards" and "scientific and technological innovation boards". Encourage qualified high-quality science and technology enterprises to issue science and technology bills and science and technology innovation corporate bonds. Guide unlisted science and technology enterprises to issue science and technology bills and science and technology innovation company bonds with conversion conditions, and solve the capital needs at different stages of development through the linkage of stocks and bonds. We will continue to carry out intellectual property securitization and promote technology-based enterprises to directly finance through intellectual property securitization products such as the patent licensing asset support plan. Support the construction of national high-tech zones and the issuance of real estate investment trusts (REITs) in new infrastructure areas such as big data, artificial intelligence and Internet of Things, and encourage the recovery of funds to expand investment in scientific and technological innovation.

Nine, guide the insurance institutions to provide support and guarantee for scientific and technological innovation.

Increase the intensity of "insurance funds entering Guangdong", strengthen cooperation with China Insurance Asset Management Association, and support insurance funds to help the development of science and technology enterprises through various means such as equity, creditor’s rights, combination of stock and debt, and funds. Encourage insurance institutions to enrich the types of insurance, and provide insurance protection for technology research and development, application and transformation of scientific and technological achievements, intellectual property rights confirmation and rights protection, and financing of scientific and technological enterprises. Explore the establishment of a provincial-level science and technology insurance product recommendation mechanism, and include the first (set) insurance for major technical equipment, the first batch of insurance for key new materials, the first edition of quality and safety liability insurance for software and other insurance products that spread the risk of scientific and technological innovation for science and technology enterprises into the provincial-level science and technology insurance product recommendation catalogue, and the provinces and cities will jointly provide certain premium subsidies for science and technology enterprises to purchase insurance products included in the recommended catalogue. Explore the construction of science and technology insurance co-insurance mechanism to provide comprehensive insurance protection for key core technology research and transformation of scientific and technological achievements.

Ten, the construction of "supplementary investment and loan" to support scientific and technological innovation linkage mechanism.

We will carry out a pilot project of "supplementary investment and loan" linkage, give play to the leading role of provincial financial science and technology funds, and build a linkage mechanism of "financial subsidy+venture capital+science and technology credit" to support the rapid development of a number of start-up science and technology enterprises with outstanding potential in key national and provincial development fields. Further play the role of venture capital institutions in the evaluation of science and technology projects and innovation and entrepreneurship events, and establish a new mechanism of "evaluation by investment" and "evaluation by competition". Support banking financial institutions to deepen cooperation with venture capital enterprises and other external investment institutions under the premise of legal compliance and risk control, explore business models such as "loan+external direct investment", and move forward financial services in the life cycle of technology-based enterprises.

Eleven, improve the level of cross-border investment and financing facilitation in science and technology.

Relying on Guangdong-Hong Kong-Macao Greater Bay Area’s major cooperation platforms such as Hengqin, Qianhai, Nansha and Hetao, we will promote the complementarity, interconnection and intercommunication among Guangdong, Hong Kong and Macao and technology and finance. Establish a green channel for foreign investors to invest in venture capital enterprises in Guangdong Province and high-tech projects that meet the requirements of the national catalogue of industries encouraging foreign investment through qualified foreign limited partners (QFLP). Support high-tech enterprises, specialized and innovative enterprises, and small and medium-sized scientific and technological enterprises to independently borrow foreign debts within the quota stipulated in the pilot project of cross-border financing facilitation, so as to further meet the cross-border financing needs of scientific and technological enterprises with small net assets.

Twelve, actively strive for financial support for scientific and technological innovation in a new round of pilot.

Intensify reform and innovation in technology and finance, and actively strive for relevant national pilot projects on financial support for scientific and technological innovation. Strive for the Guangzhou-Shenzhen Science and Technology Innovation Financial Reform Experimental Zone to land as soon as possible, increase support for the construction of the experimental zone in terms of finance, land and talents, actively explore new models, mechanisms and paths covering the whole chain of scientific and technological innovation and the financing needs of scientific and technological enterprises throughout their life cycle, and promote successful experiences in Guangdong-Hong Kong-Macao Greater Bay Area in due course. Strive for state support, and explore financial asset investment companies to carry out equity investment business of technology-based enterprises that do not aim at debt-to-equity swap in mainland cities of Guangdong-Hong Kong-Macao Greater Bay Area.

Thirteen, promote the reasonable and appropriate opening of public information resources of science and technology.

On the premise of complying with laws and regulations and meeting the requirements of confidential and sensitive information and data management, and in accordance with the requirements of building a nationwide integrated financing credit service platform network, relying on the National Comprehensive Credit Service Platform for Small and Medium-sized Enterprises, we will gradually integrate existing resources such as "Opening Guangdong", "Small and Medium-sized Enterprises", "Guangdong Credit Information Service" and "Shenzhen Local Credit Information Platform" to promote the financing docking between financial institutions and technology-based enterprises. On the basis of ensuring data security, open the basic data of intellectual property rights, which is convenient for financial institutions to obtain in batches.

Fourteen, improve the comprehensive service system in technology and finance.

Relying on state-owned venture capital institutions, we will build a collaborative innovation platform for Industry-University-Research’s investment and investment, such as "Guangdong Branch Release", and establish and improve a service mechanism for normalized investment and financing of scientific and technological innovation and the development of scientific and technological enterprises. Explore the introduction of market-oriented operating entities to host scientific and technological innovation and entrepreneurship competitions, and incite more innovative carriers and social resources such as universities, scientific research institutions, high-tech zones, technology business incubators, and creative spaces to participate in the competition, and promote the allocation of high-quality financial resources to the scientific and technological field. Relying on the Science and Technology Achievements and Intellectual Property Trading Center of Shenzhen Stock Exchange, we will build a national comprehensive service platform connecting the technology market and the capital market, and provide services such as technology trading, technology shareholding, equity financing, and technology mergers and acquisitions, so as to improve the tradeability and transformation efficiency of scientific and technological achievements. Optimize the evaluation, dynamic adjustment and long-term incentive mechanism of technology and finance service center system in the province, promote the extension of technology and finance service to counties (cities, districts) and towns, and give certain subsidies to the provincial technology and finance service center for provincial science and technology projects.

Fifteen, overall financial support for scientific and technological innovation and prevent financial risks.

Science and technology, finance and other relevant departments to establish a working linkage mechanism, strengthen policy coordination and information sharing, and promote the implementation of various measures in technology and finance. Strengthen financial support for scientific and technological innovation risk management, in accordance with the principles of marketization and rule of law, compact the risk management responsibilities of all parties, and strictly abide by the bottom line that no systematic financial risks will occur. Supervise all kinds of financial institutions in Guangdong to strengthen the main responsibility of risk prevention and control while supporting the development of science and technology enterprises, and adhere to independent decision-making, risk-taking and steady operation. Promote the deep application of technologies such as big data, artificial intelligence and blockchain in the financial field, and provide assistance for financial support for technological innovation and prevention and control of financial risks.

As the Spring Festival approaches and Spring Festival travel rush begins, many people are eager to go home after booking tickets; Big bags, small bags, carrying, pulling and carrying.

Can this baggage full of heavy love safely accompany you home? What should you pay attention to on your way home so that your luggage can accompany you home safely? Please accept this raiders!

"Lovely and charming villain" — — Huston Rockets

Special feature of 1905 film network "In order to prevent the world from being destroyed, to protect the peace of the world, to carry out the evil of love and truth, a lovely and charming villain … …” I believe that many friends like me who are in Grade 2 are familiar with the classic and magical lines in this cartoon Poké mon. It’s not easy to really be a charming villain.It can make people (within the correct scope of the three views) gnash their teeth and feel pity, which is indispensable and impressive, and can be described as the highest realm.

Heath Ledger’s "Clown" Image

There are very few "top-level" villains who can meet the above conditions one by one, butJoker, the clown played by Heath Ledger in the film, is undoubtedly one of them..In the years since Nolan’s Batman series was deified, both the character’s own creativity and Heath Ledger’s personal performance have been analyzed in detail countless times, and it is unnecessary to repeat them: everyone is afraid of clowns, and the endless and unreasonable crimes he brings are disgusting and chilling, but his extremely tragic life makes people willing to understand his desperate resistance to fate.

Villain Jiangya

At present, the villain Jiangya is a bit of a clown, but he seems to be more like a combination of a clown and Batman:Pretending to be "the light of the city", because "the city needs a beam of light", he completed the "dark trial" of the evildoers in the city in his own way (murder full of ritual sense), but he also had no scruples about involving innocent people in his own murder plan.

A mysterious, cautious, evil and full of "sense of justice" contradiction, which is exactly what Remy, the original author of "Psychological Crime" series, wants to describe as a "different and charming" villain in the final chapter of the first season. As a person standing on the opposite side of "justice", the stories, emotions and conflicts that the villain needs to bear and express are more complicated and intense."A good villain should have a complete set of values that belong to him. This value may be absurd, but it must be convincing and may even confuse people."Remy understands the creation of villains like this.

Jiangya villain image is very complicated.

From the plot of "City Light of Psychological Crime", we can see the shadow of childhood domestic violence hidden in Jiangya’s heart. This victim’s identity is not only the basis of his opponent’s worship (even distorted worship), but also gives the most reasonable motivation for his birth and action after "City Light".The real world is never simply black and white. The more three-dimensional the complexity of human nature is, the more it can touch people’s hearts."Jiang Ya incarnated’ justice’ in the middle of the night. This kind of revenge (at the first time) will make people feel very Japanese, but how should we choose when we really face the law? Such a role may arouse the audience’s relatively complicated feelings towards him. " Remy said. In other words,I’m afraid this kind of complexity is our own struggle between the correctness of the three views and the deep sympathy.

Batman confronts the clown

The clown and Jiang Ya also introduce another important attribute of the "charming" villain — —Only above the successful villain can we see better heroes.The clown throws a dilemma multiple-choice question, which makes Batman finally understand where the just soul is after experiencing confusion and pain. The same is true of Jiangya, who uses a series of murders to stir up the high emotions of the people and also test the bottom line of the protagonist. It was the murder of an innocent little girl that made Fang Mu determined to fight to the death with the "city light" in extreme resentment and collapse.

Andrew scott plays Professor moriarty in Sherlock.

Tracing back to the classics, Professor moglia in the detective novel adventures of sherlock holmes can also be called such a figure. Since the publication of the original work in the 19th century, it has been adapted into numerous versions by film and television. In the most popular BBC English drama version in recent years, actor andrew scott once again gave this deadly enemy a brand-new look with a version of moriarty, which is as crazy and magical as a clown.

Of course, in addition to these villains who need to build on the plot to display their "charming" charm, there is also a class of villains who are relatively simple and rude. They can easily circle the powder by eating people and setting bonuses.Ill-tempered, self-willed, anyway, stories and characters give infinite space, as long as you boldly release yourself, there will be a large number of fans willing to fall for it.

Tom Hiddleston plays the evil god Loki 3.

The absolute leader of this kind of villains is Loki, the evil god in the series of Raytheon by MCU. When it comes to doing bad things, he can disturb the order of the universe, destroy the heaven, piss off Dad and brush his brother around. Although it’s not bad to the bone, it’s still an absolute TOP in the jerk index. As for PK’s popularity, Loki is not lost to many characters in the same universe.

The charm of villains like them stems from this fearless madness in their hearts.Compared with all the positive characters who have to think twice about justice and the overall situation, people like Loki can be more reckless and go their own way about their persistent things, not only for the audience who saw the movie, but also for the performers, which should be a more enjoyable experience.

Many actors have expressed their desire to challenge the villain.

After writing this article, I specially searched the search engine for the keywords "Want to challenge the villain role". Among more than 150,000 related results, a series of familiar actors’ names appeared, such as Lu Han, Haoran Liu, Karry, Liu Shishi, Han Geng, Jiang Jinfu, etc. They all expressed their interest in this kind of role at a certain moment. It seems that there are really many people who have been circled by the villain. On the premise that the three views are correct, we really expect to see more and more classic villains in the future and become another kind of "light" in film and television works.

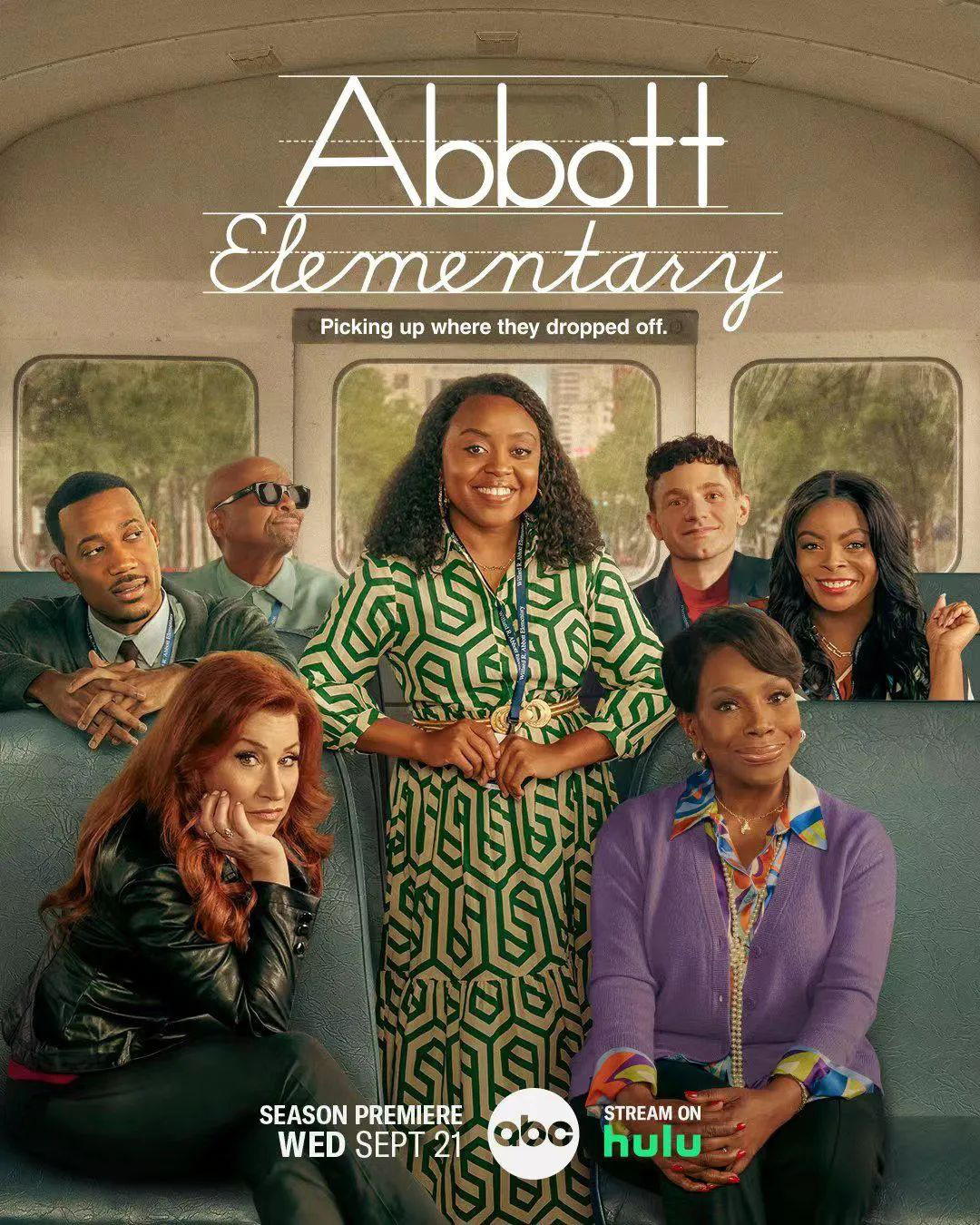

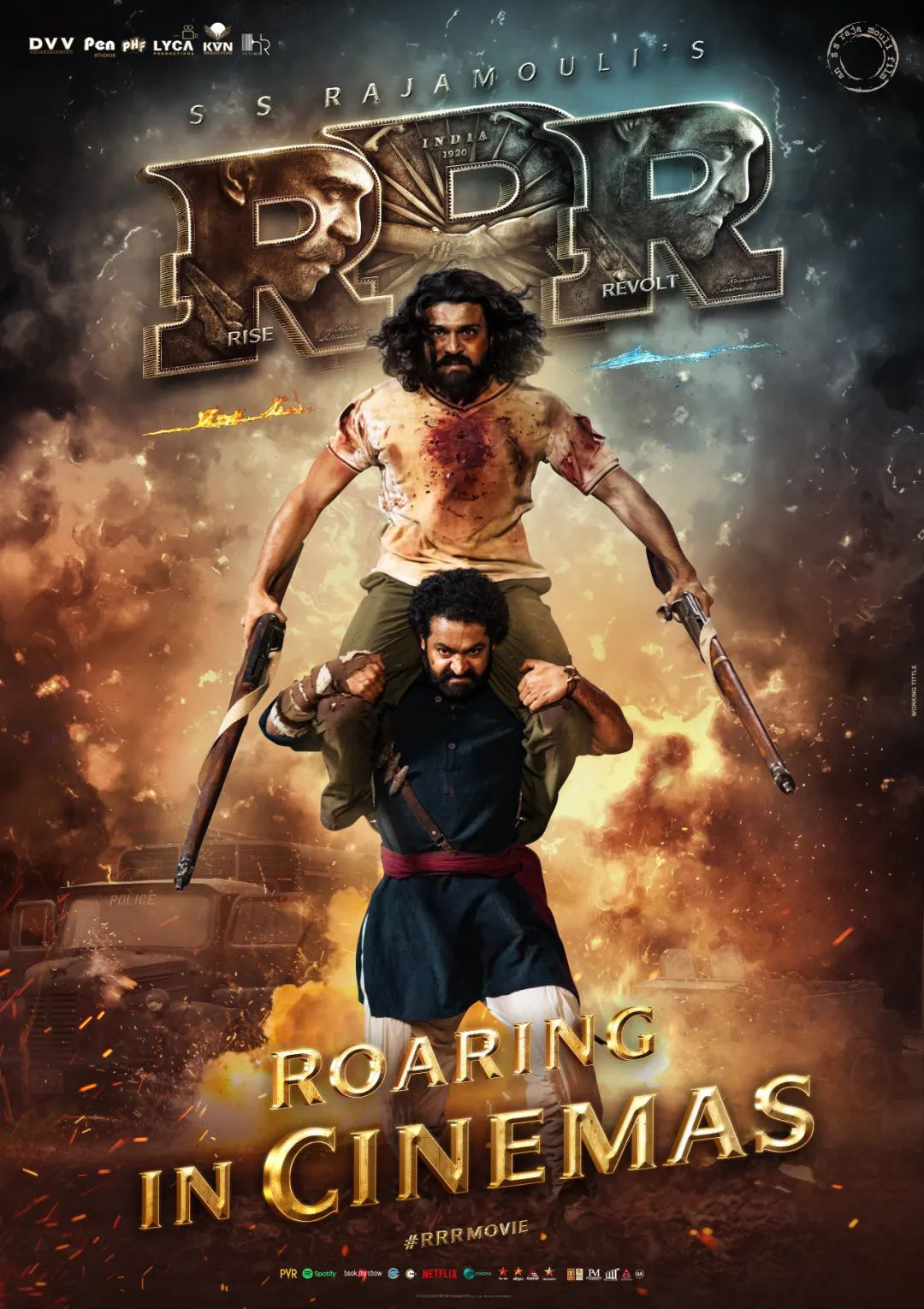

Nominations for the 80th Golden Globe Awards of American Film and Television were announced a few days ago. The drama series Abbott Elementary produced by ABC, The Banshees of Inisherin by Searchlight Film, Black Panther: Wakanda Forever by Marvel Film and RRR, an Indian musical epic, stood out.

This year, 41 actors were shortlisted for the Golden Globe Award for the first time, accounting for nearly half of the new faces. Only Julia Garner, who played "Ozark" and "Inventing Anna", won the double nomination. Regrettably, no female filmmakers have been nominated for this year’s Best Director Award. The Indian music epic film RRR continued to shine in the awards season, and it was nominated for two Golden Globe Awards-the best non-English film nomination and the best original song nomination. The Golden Globe Awards Ceremony will be held on January 10th, 2023, US time.

Traditional film and television companies are neck and neck with streaming media.

In terms of movies, Searchlight Pictures won 12 nominations this year, and only "The Banshee of Inyshelin" occupied 8. The independent film studio A24 won 10 nominations for its explosive movie Everything Everywhere All at Once, and the streaming media platform Netflix won 9 nominations, ranking second and third.

On the TV side, HBO and its streaming media platform HBO Max won a total of 14 nominations, which was the same as Netflix. Followed by Hulu with 10 nominations, followed by Disney’s cable TV network FX with 9 nominations.

Streaming media dominated the TV category this time, and ABC became the only public broadcaster nominated.

Nomination for the leading drama series of "The Storm of Primary School"

"Banshee" dominates the film nomination

RRR is a blockbuster.

The director of RRR S·S· S.S.Rajamouli who directed the Bollywood epic baahubali. The film tells the legendary story of Indian revolutionaries fighting against British colonial rule in the 1920s. Both protagonists are real people in history, but the plot of the film is basically artistic creation. The first weekend of the film’s release earned $46 million at the box office in India, setting a box office record for the premiere of Indian films.

According to Netflix, "RRR" is one of the most watched Indian movies on Netflix. Although it failed to represent India in the best international feature film Oscar, this three-hour action music film still left a strong impression in the award season at the end of the year and the beginning of the year.

Black Panther 2 makes history again.

Black Panther, directed by Ryan Coogler, was the first Marvel Comics film to be nominated for the Golden Globe Award for Best Drama. At the same time, it also created the history of superhero films being nominated for this award. The sequel Panther 2, released in 2022, achieved great success-Angela Bassett, the actress who played Queen Ramonda in the film, was nominated for best actress, which was Marvel Comics’s first performance award nomination at the Golden Globe Awards.

Award-winning favorites boycotted the Golden Globe Award.

Diversification of award nominations

(Shi Zhiyu, steve martin, Niecy Nash, Yang Ziqiong)

There are no women on this year’s nomination list for best director. Only director Shi Zhiyu was nominated for the best animated feature film for "Turning Red", and she was also the first colored woman to be nominated for the Golden Globe Award for directing the best animated feature film.

Due to years of criticism, this year’s Golden Globe Awards tend to be more diversified in terms of gender, race and age. Steve Martin, who was nominated seven times before, is 78 years old. This year, he was nominated as the best actor in a musical/comedy TV series for "Murder in an Apartment Building", becoming the oldest actor in the award nomination. Jenna Ortega, 20, became the second youngest contender for the Best Actress in Music/Comedy TV Series because of her brilliant performance in the series Wednesday.

Niecy Nash, a black actress, may become the first black woman to win the best actress in a limited series with The Monster: The Story of Jeffrey Dahmer. Viola Davis, who starred in "The Woman King", was nominated for best actress in a drama series, and may become the third black actress to win the award in history.

Yang Ziqiong was nominated for Best Actress in Music/Comedy for her leading role in the movie "A Moment of the Universe", and she is the most popular candidate for this award, which is very promising to create an award-winning history for Asians. Meanwhile, Guan Jiwei, her co-star in the film, was nominated for best supporting actor in this category, and may become the next Asian male to win the Golden Globe.

Please send the submission to the email address:

zongyiweekly@163.com

Please see the micro store for purchase.