Social Responsibility Report of CCTV (2022)

catalogue

I. Preface

Second, political responsibility

Third, the position construction responsibility

Fourth, the service responsibility

Five, the responsibility of humanistic care

VI. Cultural Responsibility

Seven, safety responsibility

Eight, moral responsibility

IX. Responsibility for safeguarding rights and interests

X. Legal Management Responsibility

Xi. Postscript

I. Preface

1. Media profile

China Media Group (CMG), officially listed on April 19, 2018, is a comprehensive international media group with the largest volume, the largest business forms, the largest program production and the widest coverage in the world.

There are 51 TV channels under the jurisdiction of the Central Radio and Television Headquarters, including 31 public channels and 20 pay channels, 9 of which are international channels. Launch 23 domestic broadcasting frequencies; Use 68 languages for external communication; Operation and maintenance of 25 new media clients such as CCTV News, CCTV Video, CGTN and Yunting, and websites such as CCTV, Yangguang.com and International Online.

2. The concept of social responsibility

The Central Radio and Television General Station always insists on guiding all work with the Supreme Leader’s Socialism with Chinese characteristics Thought in the new era, firmly supports the "two establishments" and resolutely implements the "two maintenances", faithfully fulfills the party’s duty and mission of being an ideological town, strives for progress steadily, maintains integrity and innovates, effectively serves the overall situation of the work of the party and the state, and strives to build a world-class new mainstream media with strong leading power, communication power and influence.

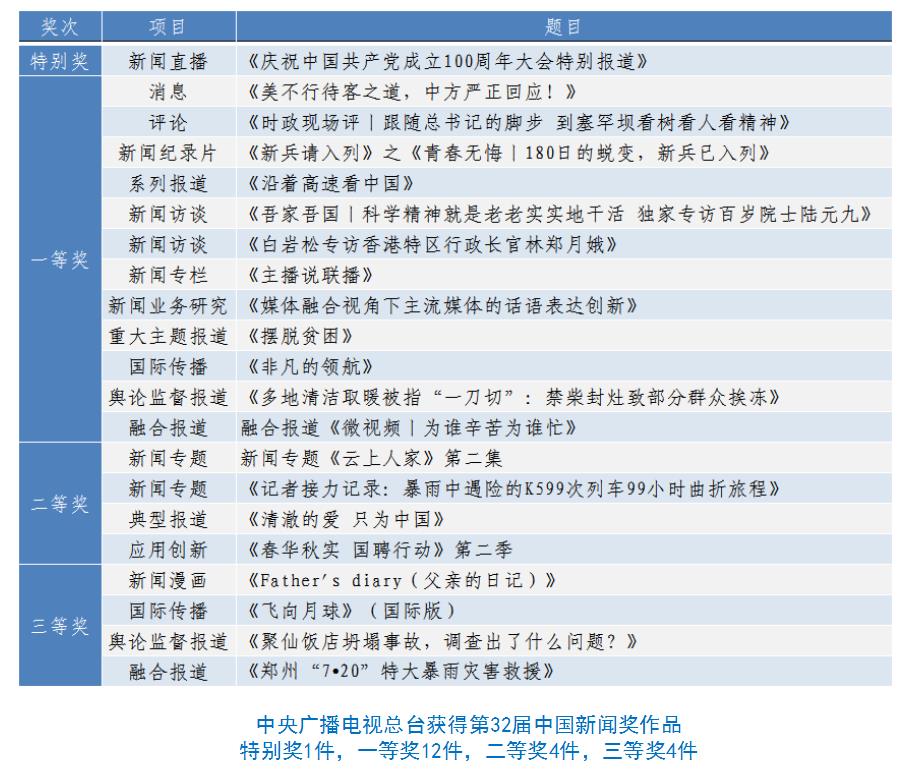

3. Awards

In 2022, 64 works and 20 collectives and individuals from the Central Radio and Television General Station won national key awards such as the "Five One Project Award" for spiritual civilization construction, the China News Award, the China Radio, Film and Television Award, and national commendation and awards such as the National May 1st Labor Medal, the National March 8th Red Flag Collective and the National Youth Post Expert.

Second, political responsibility

1. Political direction

(1) innovate and upgrade the "headline project" to promote the supreme leader’s Socialism with Chinese characteristics Thought in the new era, which is deeply rooted in people’s hearts and resonates.

Give full play to the advantages of exclusive video, carefully create the lens language, do a good job in reporting the important current political activities of the General Secretary of the Supreme Leader with heart and emotion, and firmly occupy the mainstream media public opinion to lead the commanding heights with the fastest publication time limit, the fastest on-site direct attack and the fastest response report. In the whole year, 23 major political events such as the 20th National Congress of the Communist Party of China were broadcast live, and 584 important news bulletins were issued, up nearly 23% year-on-year.

A large number of excellent programs such as Following the Footsteps of the General Secretary, Piloting, Journey, New Era, Power of Thought, Xiongan Xiongan, and China Region fully demonstrate the great practice of new ideas leading a new journey.

Strengthen the expression of international discourse, and launch a series of current political micro-videos "Meeting the Supreme Leader" and "Being with the People", a series of current political features "The Rule of China", a new media commentary video "The New Pattern of Governing the Country", a series of micro-videos "The Beginning of Poetry Printing", a series of reports "Idiom Wish" and other multilingual products. The core communication data of various current affairs reports of the International Video News Agency of the Central Radio, Film and Television General Station reached a record high, realizing the full coverage of leaders’ thoughts overseas.

(2) Give full play to the important role of the party’s propaganda and reporting on the main force of ballast stone, and go all out to perfectly present the party’s 20 grand occasions.

The report of the 20th National Congress of the Communist Party of China has created the best communication effect of "the widest coverage, the largest reach scale, the most broadcast and reprinting, and the hottest interactive topic", realizing the full coverage of all 233 countries and regions in the world historically, and expanding the number of reporting languages to 68 on the basis of its own 44 languages; Historically, all the so-called "countries with diplomatic relations" of the Taiwan Province authorities were broadcast on the ground, and a major breakthrough was made. News Network, News and Newspaper Summary and other key columns broadcast a series of reports such as "Twenty Great Times", "Great Rejuvenation and Magnificent Sail", "Seeing China with Rivers Pentium" and "Seeing Development in the County", which received enthusiastic response at home and abroad.

(3) Focus on gathering strength to do major events and thematic reports, show the practical power of Chinese modernization in multiple dimensions, and continue to consolidate and expand mainstream public opinion.

The coverage of the Beijing Winter Olympics reached a total audience of 62.814 billion people on the multi-platform of the Central Radio, Film and Television General Station, making it the highest-rated Winter Olympics, with a record-breaking communication effect. Programs such as "The Covenant of Ice and Snow" and "Together on the Ice and Snow" vividly depict the grand picture of China’s "300 million people participating in the ice and snow movement" from vision to reality.

The propaganda to celebrate the 25th anniversary of Hong Kong’s return to the motherland is vivid. Various works such as Live Greater Bay Area, Xiangjiang River Running Forever, Witness to the Forbidden City in Hong Kong and Story under the Lion Mountain are spread in a matrix, and CGTN Record Channel and Voice of Guangdong-Hong Kong-Macao Greater Bay Area frequency channel are broadcast in Hong Kong.

Successfully completed the publicity and coverage of major events such as the National People’s Congress, Boao Forum for Asia, China International Import Expo, China International Consumer Goods Expo, China International Fair for Trade in Services and Central Economic Work Conference.

2. Public opinion guidance

Sing the chinese’s theory of bright economy.A series of reports, special programs and brand activities, such as China Economic Watch in 2022, Financial List in 2022, First-line Investigation, China Confidence, CCTV Financial Forum in 2022, and Survey of China’s Good Life, were launched to fully demonstrate the long-term development trend of China’s economy.

Do a good job in epidemic prevention and control and food safety reporting.What are the new changes in the "National Health Commission: China’s current epidemic prevention and control has entered a new stage, and the implementation of" Class B and B management "focuses on strengthening services and guarantees" and "New Ten Articles for Optimizing Epidemic Prevention and Control" issued by multi-platform authorities? News such as "Boosting Confidence in Action" and "Three Years: Three Questions and Three Answers" and other media products. News Network launched the column of agricultural production "On the Field of Hope", and Voice of China launched a series of reports such as "Chinese food on the plate, China grain", which vividly recorded the extraordinary achievements of China’s grain production "19 consecutive harvests".

Strengthen the guidance of public opinion in social hotspots.We will firmly grasp the reports of social hot events such as the incident of giving birth to an eight-child girl in Fengxian County, Jiangsu Province, the beating incident in Tangshan barbecue shop, and the case of Lao Rongzhi, and present the truth at the first time, and the authoritative voice will effectively guide public opinion.

Innovative means of communication.The media coverage "Decoding Ten Years" innovatively uses the way of "satellite perspective+big data survey+news story" to present the historic achievements and changes of the party and the country. Innovative technology applications, current political pictorial, current political Vlog, Ten-year Picture Scroll, Flower Growers’ Flowers All the Way in this Decade, and other grounded, aura and empathetic media products highlight young expressions.

3. Public opinion supervision

Public opinion supervision is normalized and long-term.The theme of "March 15th" special program is "fair and honest consumption with peace of mind", which exposes problems such as unauthorized capture of users’ browsing data, inferior "pothole" sauerkraut, and hidden dangers of "medical beautician" crash course. The voice of the economy "Everyday March 15th" helps a large number of consumers successfully safeguard their legitimate rights and interests.

Adhere to constructive supervision by public opinion.Focus Interview, News Survey, News 1+1, Weekly Quality Report, Front Line and so on launched several exclusive in-depth investigation reports on telecom fraud, illegal modification of electric bicycles, and the safety of residents’ self-built houses. The news channel continued to follow up and report the tattooing chaos of minors for one year in a row, and promoted the promulgation of the Measures for the Management of Tattoos of Minors; Voice of China exclusively investigated "More than a thousand engineering quality inspection reports in Baoji, Shaanxi Province are suspected of fraud" to promote special treatment throughout the country.

4. External communication

Established the column "High-end Interview".Interview with foreign heads of state, government and heads of international organizations by bilingual anchors, explain China’s initiative, China’s proposition and China’s wisdom, and powerfully convey the voice of justice to the world to strengthen multilateral cooperation and promote the reform of the global governance system.

Vigorously and effectively carry out the international public opinion struggle.CGTN planned and launched the American Mourning, The Eternal War Machine, America Kidnapped by Guns, Exposing and Criticizing the Seven Deaths of Western Mainstream Media, and criticizing the "four-part" of the United States, which aroused widespread concern in global public opinion. The International Sharp Review published 236 comments, and the fans of Yuyuan Tan Tian exceeded 8 million, seizing the commanding heights of international public opinion.

Comprehensively improve the efficiency of international communication.Improve the rapid response mechanism of global emergencies, and the global initial rate of international news reaches 14.55%, ranking second among the major media in the world. Quickly expose and criticize Pelosi’s visit to Taiwan Province, China, and related reports have become the main source of global media. Video news related to the Russian-Ukrainian conflict has been adopted by 2,581 TV stations and new media platforms in 127 countries and regions for over 830,000 times, setting a record in the history of international hot events.

Innovatively carry out "media diplomacy".Successfully held the first global media innovation forum, the China-Argentine high-end cultural exchange forum, and participated in the hosting of the "Global Development: Common Mission and Action Value" think tank media high-end forum. Guided by the diplomacy of the head of state, we signed cooperation agreements with multinational government agencies and mainstream media. Innovatively held 58 overseas media activities of "China and the World on a New Journey" to effectively introduce the spirit of the 20th Party Congress.

Promote cultural exchanges between China and foreign countries.Successfully held a series of media activities, such as the United Nations Chinese Day in 2022 and the second overseas video festival of China Central Radio, Film and Television Station, the first global screening of China Video Festival, the first film screening of China-Latin America Love, the media cooperation of ASEAN partners and the 2022 China-Arab media cooperation forum.

Third, the position construction responsibility

1. Strengthen the construction of all-media communication system.

The cumulative download volume of the central video client exceeded 491 million times, and the cumulative number of active users was 185 million. The user scale and active users ranked first in the new media platform of the central media.

The total download volume of CCTV news client exceeded 191 million times, and the number of users of social platforms exceeded 738 million, an increase of nearly 100 million.

The number of users of cloud listening client is close to 200 million, ranking first in the audio industry in terms of scale growth.

There are more than 200 million monthly users of CCTV. The number of users of the new media platform "Voice of Greater Bay Area" has doubled, and the new media "Looking at the Taiwan Strait" ranks among the first phalanx of China’s communication to Taiwan. Release the "Evaluation System of Short Video Media Communication" and launch the "Elephant Dance Index" to evaluate the brand.

2. The strategy of "5G+4K/8K+AI" has achieved fruitful results.

Successfully completed the first 8K international public signal production in the history of the opening and closing ceremonies of the Olympic Games and key events, and realized the entire 4K broadcast of the Olympic Games for the first time. "CMG Media Cloud Helps Olympic Communication" and "Beijing Winter Olympics Virtual Studio and Winter Olympics 5G Train Live Broadcasting" won the Olympic Golden Ring Award. CCTV-8K ultra-high-definition channel was launched, and the "100 cities and 1000 screens" public large-screen project covered 21 provinces, autonomous regions and municipalities across the country, and the "5G+4K/8K ultra-high-definition production and broadcasting demonstration platform" formed production capacity. Eleven research platforms, such as Ultra HD Production Technology Research Laboratory, 5G Media Application Laboratory, All Media Convergence Communication Technology Research Laboratory and New Display and Visual Perception Shicheng Laboratory, promote the transformation and application demonstration of scientific and technological achievements in multiple dimensions with the scientific and technological innovation mode of "production, learning, research and use".

3. The deep integration of media continues to advance.

In 2022, the first vertical screen was launched to watch the Spring Festival Evening, with a cumulative audience of 439 million. The central video "This young Summer", "young Flowers on Weekend" and "young Flowers" are wonderful enough — — Central Video Night and other "Central young" series products continue to be screened, and the cumulative video playback volume exceeds 700 million times. "Sanxingdui Fantasy Tour" provides users with a brand-new immersive experience through instant cloud rendering technology. Develop AI sign language translators to help hearing-impaired people watch the live broadcast of Beijing Winter Olympics smoothly.

Fourth, the service responsibility

1. Information services are timely and accurate

News and information programs timely and accurately release authoritative government information and policies to benefit the people, and do a good job in service tips. Launched 233 live cloud recruitment broadcasts of "Don’t Live Up to China’s Employment Action" to promote the efficient connection between job seekers and jobs. China Report on Agriculture, Countryside and Farmers, Rural Service Agency, etc. "China Twenty-four Solar Terms Series Short Video" makes the audience feel the wisdom of the ancients in the ancient paintings of solar terms.

2. Social services are effective.

Build a public service platform for media integration."Sunset Red" launched a number of medical popular science sections to create a health popular science platform. The media column "I do practical things for the masses" promotes the government to solve the "urgent difficulties and worries" of the masses, and the column "Thousands of jobs and hundreds of products" creates a communication platform between labor brands and employment enterprises.

Play the role of a public think tank.CGTN think tank launched the global poll of "China in the new era" and "China on the new journey"; More than 20 media events were held, such as "China Opportunities and World Development under Global Change", "Chinese Modernization and the World" and "Global Youth Talk: China Development and Youth Opportunities".

3. Continue to promote public welfare activities

Around the 20th Party Congress, model of the times, ecological civilization, traditional culture and other themes, 86 themed public service advertisements were created, which were broadcast nearly 490,000 times on 17 TV channels and broadcasting frequencies of the Central Radio and Television General Station.

Designated to help Xide County, Sichuan Province and Beijing and Shanghai to build a new era civilization practice center. Through improving school conditions, setting up scholarships, building public welfare canteens for the elderly, donating cultural equipment, and introducing industrial projects, Xide County was helped in many ways, helping to sell agricultural products in poverty-stricken areas for 59.4384 million yuan and training 2049 grassroots and technical personnel.

Carry out cultural assistance activities such as "Model of Rural Revitalization" public welfare communication, "Luming Literature Classroom" announcer and host public welfare class, and famous painters’ creative work. The theme public welfare activity "Mind Cinema" tells movies for the blind, and "Holding Hands with Big Hands" provides public welfare assistance for left-behind children, disabled and special children in send warm. Actively participate in blood donation, charitable donation and voluntary service.

Five, the responsibility of humanistic care

1. People’s livelihood coverage is extensive.

Continue to do a good job in people’s livelihood reports such as employment, medical care, education, and old-age care, and timely release authoritative information and convenience measures. CCTV Children’s Channel, the Voice of the Elderly in Yangguang, and national language broadcasting fully reflect the concern and care of the party and government for children, the elderly, ethnic minorities and other groups. Combine ethnic festivals, International Women’s Day, International Children’s Day, Double Ninth Festival, International Day of Disabled Persons and other special reports to reflect China’s efforts and achievements in safeguarding the rights and interests of special groups.

2. Disaster and accident reports are comprehensive and objective.

In the sudden and natural disasters, such as the flight accident of China Eastern Airlines MU5735, the collapse of residents’ self-built houses in Changsha, Hunan, the sinking of the "Fujing 001" in distress, the earthquake of magnitude 6.8 in Luding County, Ganzi Prefecture, Sichuan Province, and the mountain fire in Beibei, Chongqing, timely and authoritatively report the progress of the events, respond to social concerns at the first time, refute rumors and effectively guide public opinion.

3. Humanities programs deliver positive energy

Record the spiritual strength of upward goodness.A series of reports, such as Ten Years We Are All Dreamcatchers, Strugglers Are Young, Micro-recording My Story and Economic Voice "Glowing Youth", record the dream-chasing stories of Chinese people in the new era, and present the great changes and rapid development of our country from different aspects. My beautiful countryside creates a strong atmosphere of "paying attention to agriculture, caring for the countryside and caring for farmers" in the whole society.

Pay attention to teenagers’ physical and mental growth."The first lesson of school in 2022, struggle to achieve dreams", "Dream with childlike innocence in the future, to you as a teenager" spread the spirit of the times with the growth stories of role models, and inject positive spiritual energy into the growth of teenagers. With the theme of "inheriting the spirit of scientists and cultivating the feelings of home and country", "Let’s Talk" guides the younger generation to make great efforts. "Snow Dream Group" makes teenagers feel the charm of ice and snow sports. Special programs such as Protecting Teenagers, Love in the Last Mile, and Guardians of Growth pay attention to the health and safety education of minors, especially left-behind and troubled children.

VI. Cultural Responsibility

1. Vigorously carry forward the socialist core values

Uphold the party style, be honest with the people, promote the family style, and cultivate a new style.Reports on the Party’s work style and clean government, the feature film "Zero Tolerance" and other programs fully reflect the firm determination of the CPC Central Committee to punish corruption. The cultural tourism visit program "Home between Mountains and Waters" shows the magnificent picture of the countryside in the new era in a panoramic way. In the World, Dear Children, Living in Mind, Come on! Teleplays such as Mom, Exam, Family Affairs as Heaven, Family Style and Family Education Concept of Civil Code and other programs show a harmonious and upward-oriented family atmosphere and carry forward the new trend of family civilization in the new era.

The propaganda of the Chinese dream is cohesive.Special programs such as "Chinese Dream Ode to the Ancestor", "Chinese Dream Work Beauty" and "Struggling Youth" write a new era and a new chapter. Film and television dramas and documentaries such as Seeds, Keeping China’s Rice Bowl Firm, Beautiful Mountains and Rivers, and Daughter of Dashan show the earth-shaking changes in rural areas of China and the effective implementation of the rural revitalization strategy. Natural ecological documentaries such as Aerial Photography of China (Season 4), The Power of Nature, Life on the Earth and Meeting the Extreme China witnessed the development concept of "building a harmonious beautiful homeland for all things".

2. Promote the creative transformation and innovative development of Chinese excellent traditional culture.

Activate the vitality of Chinese culture.Special programs such as Spring Festival Gala in 2022, Lantern Festival Gala, Mid-Autumn Festival Gala, Qixi Festival Gala, Dragon Boat Festival, Chongyang Festival and Affectionate Land are carefully produced around Chinese traditional cultural festivals to fully demonstrate the influence, cohesion and appeal of Chinese civilization. Innovative launch of "Ancient Rhyme and New Sound" traces the cultural connotation of traditional festivals, helping to strengthen the cultural confidence of the Chinese nation.

Original boutique explosions continue.Cultural brand programs such as Word Meets You, China in Art, China in Poetry and Painting, Rong Baozhai, China in Classics, China in Stories, China National Treasure Conference, 2022 Chinese Poetry Conference, Olympics in Art, Biographies of Masters, Encountering Civilization and China in Intangible Heritage realize "Thought+Art+"

3. Promote the scientific literacy of the whole people.

Pay attention to major scientific and technological achievements such as the construction of China’s space station, Mars exploration and manned deep diving. "Tiangong Classroom" continues to carry out space teaching activities. 4K documentary "hello! Mars records the whole process of China’s first Mars exploration. The series of documentary "Smart China" shows the frontier development and product landing in the field of artificial intelligence technology in China. Programs such as "Cracking the Code of Life", "The Law of Changing the World" and "2021 Popular Science China Announcement Ceremony" have created a strong atmosphere of loving science in the whole society.

Seven, safety responsibility

Achieve safe broadcast throughout the year.The efficiency of technical support services has been continuously improved, the business process norms of "three trials and three schools" and "replay and retrial" have been compacted, the process management mechanisms such as pre-editing meeting, program monitoring and monitoring, and post-broadcast public opinion monitoring have been strictly implemented, and emergency response plans have been established to effectively ensure the successful completion of various publicity reports.

Eight, moral responsibility

1. Abide by professional norms

Strictly abide by laws and regulations such as "China Journalists’ Professional Ethics Code" and "Measures for the Administration of Radio and Television Advertising", adhere to the principle of news authenticity, resolutely put an end to paid news, and resolutely resist vulgarity and kitsch. We will improve the working mechanism of all-media copyright protection, and successfully complete the copyright protection of programs such as Spring Festival Evening, Beijing Winter Olympics and FIFA World Cup Qatar 2022.

2. Maintain social morality

"Touching China 2021 People’s Awards Ceremony", "The Spirit of the Constitution and the Power of the Rule of Law — — Special programs such as 2022 Rule of Law Figures and the Power of Example (the first season) set an example, praising virtue, generosity and righteousness. We will strengthen publicity on topics such as drug control, fire safety and traffic safety, and launch programs such as Bright Sword 2022, War on Drug Control 2022, Walk Safe 2022 and pride of chinese.

3. Accept social supervision

Strictly implement the "Measures for the Administration of Journalists’ Cards", and reporters will produce legal and valid journalists’ cards during interviews. Permanent petition departments, broaden feedback channels, actively collect and actively deal with the comments and complaints of local people on programs and personnel.

IX. Responsibility for safeguarding rights and interests

1 to protect the legitimate rights and interests of editors.

Support the editors to carry out normal editing activities, and timely declare the journalist assistance project in China for qualified employees. Do a good job in sending first aid packages to overseas employees, overseas emergency rescue insurance and other commercial insurance services.

2. Guarantee the remuneration and benefits of employees.

Standardize the signing of labor contracts, pay "five insurances and one gold" on time, and solidly promote the work residence permit and the settlement of points. Steady operation of the salary distribution mechanism to provide positive incentives for employees. Formulate regulations on extending maternity leave and parental leave, and effectively protect employees’ rights and interests such as vacation.

3. Standardize the management of journalists’ cards

In strict accordance with the work requirements of the State Press and Publication Administration, we will conscientiously do a good job in the application, verification and daily management of press cards for news editors. In 2022, the annual verification of 6,629 journalists’ cards was completed, 89 new cards were applied, and 108 journalists’ cards were cancelled.

4. Innovative talent training mode

Adhere to the integrated planning, deployment and promotion of political quality training and professional ability improvement, and build a training system based on offline training, online classroom and online live training. More than 220 training sessions were held throughout the year, with a total of 112,000 person-times, with a total duration of over 430,000 class hours.

X. Legal Management Responsibility

Conscientiously implement the requirements of "advertising should also be oriented", abide by national laws and regulations, and standardize various business behaviors. Adhere to the social benefits in the first place, strictly separate editing and management, and issue the Interim Provisions on Advertising Management of the Central Radio and Television General Station, and do not publish and broadcast illegal advertisements.

Xi. Postscript

In view of the shortcomings in 2021, the Central Radio and Television General Station insisted on being upright and innovative, and launched a large number of excellent programs, forming a vivid situation in which fine products gushed and colorful; In the field of international public opinion, we strive for the first place, dare to show our swords and strive for exclusivity. Our voice is getting louder and louder, our status is getting heavier and heavier, and there are more and more friends. Our international communication power continues to soar. Accelerate the transformation from traditional radio and television media to all-media organizations that produce and publish world-class original audio and video, from traditional program production and broadcasting mode to deepening the structural reform of content production and supply side, and from traditional technology layout to the strategic pattern of "5G+4K/8K+AI".

There are still some shortcomings in the work in 2022, mainly in terms of international communication capacity building, innovation drive and creative development.

In the future, the Central Radio and Television General Station will always insist on guiding all work with Socialism with Chinese characteristics Thought of the Supreme Leader in the new era, deeply understand the decisive significance of "two establishment" and push "two maintenance" to a new level. Further deepen and upgrade the "headline project", adhere to pragmatism, accuracy, high quality and efficiency, deepen the spiritual propaganda of the Party’s 20th Congress, and provide strong public support for a good start in building a socialist modern country in an all-round way; Further strengthen the construction of international communication capacity, vividly tell the story of China, tell the story of the Communist Party of China (CPC) and tell the story of the new era, and consolidate and deepen the good communication situation; Further highlight innovation, vigorously promote the whole chain, all-round and all-field innovation, create a new media platform full of innovation, creativity and hope, and consolidate and enhance the leading position in the field of ultra-HD and new media. Strive to build a world-class new mainstream media with strong leading power, communication power and influence.