This report is compiled in accordance with the requirements of the Regulations of People’s Republic of China (PRC) Municipality on the Openness of Government Information and the Regulations of Beijing Municipality on the Openness of Government Information, and based on the annual reports of various government information disclosure agencies in Miyun District of Beijing in 2018.

The full text includes the key work of information and government affairs disclosure of Miyun District Government in Beijing in 2018, the release and interpretation of information in key areas, the existing shortcomings and the next key work, as well as the relevant data of government information disclosure such as active disclosure, response interpretation, disclosure upon application, administrative reconsideration, administrative litigation and reporting.

The statistical period of the data listed in this report is from January 1, 2018 to December 31, 2018. The electronic version of this report can be downloaded from the government information disclosure column of "Beijing Miyun" website.

In 2018, Miyun District thoroughly studied and implemented the spirit of the 19th National Congress of the Communist Party of China and the Second and Third Plenary Sessions of the 19th Central Committee, and under the guidance of Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era, thoroughly implemented the Opinions on Comprehensively Promoting the Openness of Government Affairs and the Implementation Rules of Opinions on Comprehensively Promoting the Openness of Government Affairs. In accordance with the requirements of "Key Points of Government Affairs Openness in Beijing in 2018" (Beijing Zhengban Fa [2018] No.19) and "Notice of the General Office of Beijing Municipal People’s Government on Promoting Government Information Openness in Some Key Areas" (Beijing Zhengban Zi [2018] No.23), we will strive to achieve new breakthroughs in the fields of information openness, government affairs openness, interpretation and response, public participation, website construction and so on around the work of two-level centers in urban areas.

First, the annual key work

(1) Strengthen organizational leadership and improve system construction.

Implement the "Regulations on the Openness of Government Information in People’s Republic of China (PRC)" and strictly implement the review procedures for government information disclosure. Before the disclosure of government information, it should be strictly examined according to laws and regulations, and the relationship between information disclosure and keeping state secrets should be properly handled. Strengthen the analysis and judgment on the content expression, the timing and the way of publicity, so as to avoid problems such as information release breaking faith, causing improper speculation, damaging the credibility of the government and affecting social stability. For government information involving personal privacy, in addition to disciplinary public announcements and mandatory information disclosure, it is necessary to do a good job of de-marking when making public, and protect the personal information of relevant personnel according to law.

On the basis of in-depth investigation and extensive solicitation of opinions, we will compile and issue the Key Points of Government Affairs Disclosure in Miyun District of Beijing in 2018 and the Notice of Beijing Miyun District People’s Government Office on Promoting Government Information Disclosure in Some Key Areas, refine the disclosure tasks, clarify the division of responsibilities, earnestly implement the government information disclosure in areas such as financial budget and final accounts, approval and implementation of major construction projects, allocation of public resources, and construction of social welfare undertakings, and disclose relevant information in a prominent position on the portal website.

Strengthen policy interpretation and establish a full chain management mechanism for policy interpretation. The "Implementation Plan for the Public Release and Interpretation of Policy Documents of Administrative Organs in Miyun District of Beijing" was issued, focusing on the key work of the district government in 2018, further intensifying the interpretation, and insisting on the simultaneous research, deployment and promotion of important documents, major decisions, key work and policy interpretation, and rationally guiding social expectations. Implement the interpretation of the whole chain management, and do a good job of policy briefing interpretation and expected guidance before the document is published; When the document is published, the relevant interpretation materials and documents are published on the government website and the media simultaneously; During the implementation of the document, the public opinion should be closely followed, interpreted in sections, multiple times and continuously, and doubts and doubts should be solved in time to enhance initiative, pertinence and timeliness.

We will promote openness in decision-making, establish a system of pre-disclosure and implementation of major decisions, and regard openness and transparency as the basic requirements of government work. For major decisions that involve the vital interests of the public and need to be widely known by the society, administrative organs at all levels announce the draft decision and decision-making basis to the public before making decisions, and listen to public opinions extensively. The time for soliciting opinions is generally not less than 5 working days. After soliciting opinions, timely disclose the adoption of opinions; Explain the reasons for not adopting the relatively concentrated opinions and suggestions. Promote the disclosure of the implementation of important policies and measures and key tasks, and fully disclose information such as implementation steps, specific measures, division of responsibilities, and work progress.

(2) lay a solid foundation for work and make information public.

First, broaden the breadth of publicity and do a good job of active publicity. In accordance with the scope of active disclosure required by the Regulations of People’s Republic of China (PRC) Municipality on the Openness of Government Information and the Regulations of Beijing Municipality on the Openness of Government Information, we should carefully sort out government information, improve the dynamic catalogue of information attribute conversion and the system of examination and approval, and operate the dynamic management mechanism of converting undisclosed information into public information and converting information into active public information according to application. As of December 31, 2018, the whole region had voluntarily disclosed 52,714 pieces of government information through the government information disclosure column of Beijing Miyun website. Among them, 9291 pieces of information were voluntarily disclosed this year, including 411 pieces of administrative duties, 265 pieces of institutional functions, 243 pieces of planning, 7647 pieces of business dynamics and 725 pieces of regulatory documents. The district government regularly transfers 972 copies of paper government information to the urban two-level government service halls, libraries, archives offices and other units; More than 2,000 copies of the Miyun District People’s Government Bulletin were compiled and distributed in four issues. The information disclosure window of the district government received 1,313 consultations this year, including 710 telephone consultations, 603 on-site consultations, 420 on-site visits and 1,630 column visits.

The second is to strictly administer according to law and standardize the application. In 2018, Miyun District strictly regulated the open work according to the application. Ensure that the acceptance channels and consultation telephones are unblocked; Ensure the legality of the reply time limit, the standardization of the reply form, and the standardization and pertinence of the reply content; Ensure that the relevant provisions of the Regulations on the Openness of Government Information are quoted in the reply notice, and the relief channels are clearly indicated; Ensure the completeness of the statutory contents of the Guide to the Openness of Government Information; Ensure the accuracy of the public places indicated in the Guide to the Openness of Government Information. As of December 31st, 461 applications have been accepted by public institutions in the whole region this year, including 39 by the district government and its offices, 104 by towns and streets, 180 by district departments and 138 by manubrium departments. Organized more than 50 special conferences and successfully handled many difficult and complicated applications. All units replied to the applicant within the prescribed time limit, and the satisfaction rate of the reply was 100%, which led to 3 administrative reconsideration and maintained the reply made by the administrative organ; No administrative proceedings have taken place. The contents of the application mainly focus on land requisition and demolition, project examination and approval, urban planning, financial funds, environmental protection, social security and other issues involving the vital interests of the masses. The key tasks involved in the application include the renovation of large-scale livestock farms in the forbidden areas, the renovation of shanty towns in Wanggezhuang Village of Shilibao Town, the construction of 50 village-level medical pension facilities, the collective land requisition and demolition of Miyun section of Beijing-Shenyang Passenger Dedicated Line, and the renovation of shanty towns in Liulinchi area, a new countryside in Mujiayu Town.

(three) around the central work, promote the openness of government affairs.

1. In strict accordance with the work requirements of the Notice of the General Office of Beijing Municipal People’s Government on Printing and Distributing the Key Points of Beijing’s Government Affairs Disclosure in 2018 (No.19 [2018] of Beijing Municipal Government Office) on the disclosure of government information in key areas, and in accordance with the division of labor plan determined by the Notice of the General Office of Beijing Municipal People’s Government on Promoting the Disclosure of Government Information in Several Key Areas (No.23 [2018] of Beijing Municipal Government Office), we will earnestly do a good job in financial budgeting. Fully disclose financial budget and final accounts information, and formulate measures for the disclosure of government debt information at the municipal and district levels. Combined with the actual selection of major construction projects with high social concern in the region, we should highlight the publicity of the winning bid results, the conclusion and performance of the contract, the land acquisition plan, the land acquisition compensation and resettlement plan and other information. Do a good job in the disclosure of public resources transaction announcements, qualification examination results, transaction process information, transaction information, performance information and related change information according to law, and promote the transparency of the whole process of public resources allocation. We will further promote the disclosure of information such as accurate poverty alleviation, social assistance, food safety, investigation and handling of major environmental pollution and ecological damage incidents, and pay attention to the use of technical means to realize the retrievability, verification and utilization of public information.

2. Explore the compilation and full implementation of the Full List of Government Affairs Openness in Miyun District. We will fully implement the basic directory system of voluntary disclosure, and explore the preparation of a full list of government affairs disclosure on the basis of the public list of key areas. Twenty towns, streets and 45 district government departments will comprehensively sort out the government information in the process of performing their duties, find out the base, and initially complete the "Full List of Government Affairs Disclosure in Miyun District", which was submitted to the general office of the municipal government on June 20. At the beginning of November, the district government office organized a work promotion meeting to deploy and implement the contents of the "Full List" to be fully disclosed. Before December 20, 65 units in the whole region realized that public information covered the whole process of government affairs, so as to be "open and open".

3. Strengthen the interaction between the government and the people and promote the opening of meetings. Establish and improve the system of NPC deputies, CPPCC members, experts and scholars, and citizen representatives to attend government meetings as nonvoting delegates, and enhance the transparency of decision-making. The 43rd executive meeting of the district government selected the topic of "Planning and Allocation Plan of Life Service Industry in Miyun District submitted for approval by the District Commercial Committee", invited two representatives of citizens to attend, and put forward opinions and suggestions on this topic. The participants warmly applauded the speeches of the representatives of citizens, and Pan Linzhu, the district head, thanked them for their suggestions and suggestions. When the Office of the Director of the District Civil Affairs Bureau deliberated and allocated the issue of subsidizing the electricity consumption of urban and rural low-income families in the third quarter of 2018, it invited NPC deputies, CPPCC members and low-income residents to attend the meeting as nonvoting delegates, which also achieved good results. Other towns, streets and departments have also established relevant mechanisms to open meetings one after another.

4, expand public participation, to carry out government affairs open day activities. Formulate the activity plan of the government open day, and select the district government service office, the district people’s insurance bureau, the district food and drug administration, the Gulou street, the orchard street and other departments and towns and streets as pilot units to carry out the "zero distance between the government and you" government open day activity in advance. Established three activity themes: government service, comprehensive law enforcement and safety supervision, and set up six open points. Publish an announcement on the government website in advance and invite the general public to sign up. On November 30th, the Employment Hall and Social Security Hall of the District People’s Insurance Bureau took the lead in opening to the public, invited citizens’ representatives into the office hall, watched the business process, exchanged views with window business personnel, and listened to everyone’s opinions and suggestions. Gulou Street, Orchard Street, District Government Affairs Service Office and District Food and Drug Administration have also carried out government affairs opening activities one after another. Citizens walked into government affairs service centers, comprehensive law enforcement centers and food safety monitoring stations to let the people know about the government’s work all the time, and had discussions with district people’s congress representatives and citizens’ representatives, from asking the citizens to see and listen to what they said, so as to let them feel the determination and sincerity of the government to do a good job at their doorstep.

(4) Strengthen platform construction and promote the intensification of government websites.

Conscientiously implement the "Guidelines for the Development of Government Websites" and issue the "Work Plan for the Implementation of the" Guidelines for the Development of Government Websites "by the Miyun District People’s Government Office in Beijing. Strengthen the content construction of government websites, enrich information resources, and strengthen functions such as information search and service. Strictly carry out the integration process of government websites and standardize the management of government website names and domain names. Vigorously promote the intensification of government website construction, strengthen website construction and integrate information resources. The website integration of Miyun district government was completed ahead of schedule, and 51 government websites have migrated their data to the portal website of the district government, realizing "one network in the whole region". At present, the district government website does not support Internet Protocol Version 6 (IPv6) for the time being, and the new version of the district portal website is under construction, and will support Internet Protocol Version 6 (IPv6) after it is put into operation.

(5) Strengthen diversified training and improve the quality of the team.

Organized four large-scale trainings in the whole region, involving the upgrading and transformation of the open system, the preparation of the full list of government affairs disclosure, the integration and construction of government websites and the promotion of government affairs disclosure, with more than 420 participants; Carry out 4 batches of open special training according to the application, and participate in more than 50 trainings; Continue to strengthen peer-to-peer guidance, guiding more than 200 people. Through training, the awareness of leaders and staff in charge of various departments and towns and streets in administration according to law and openness of government affairs has been further enhanced, and the ability to handle applications and manage websites has been strengthened.

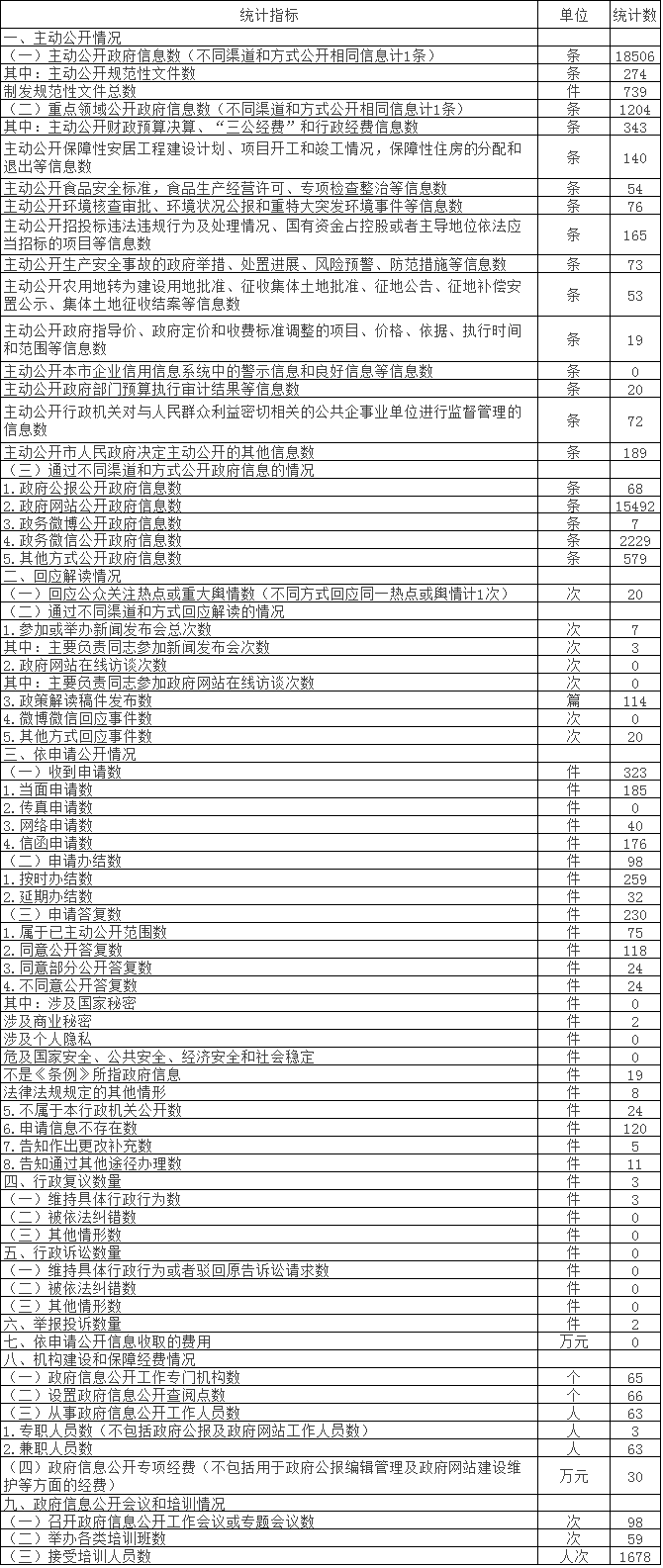

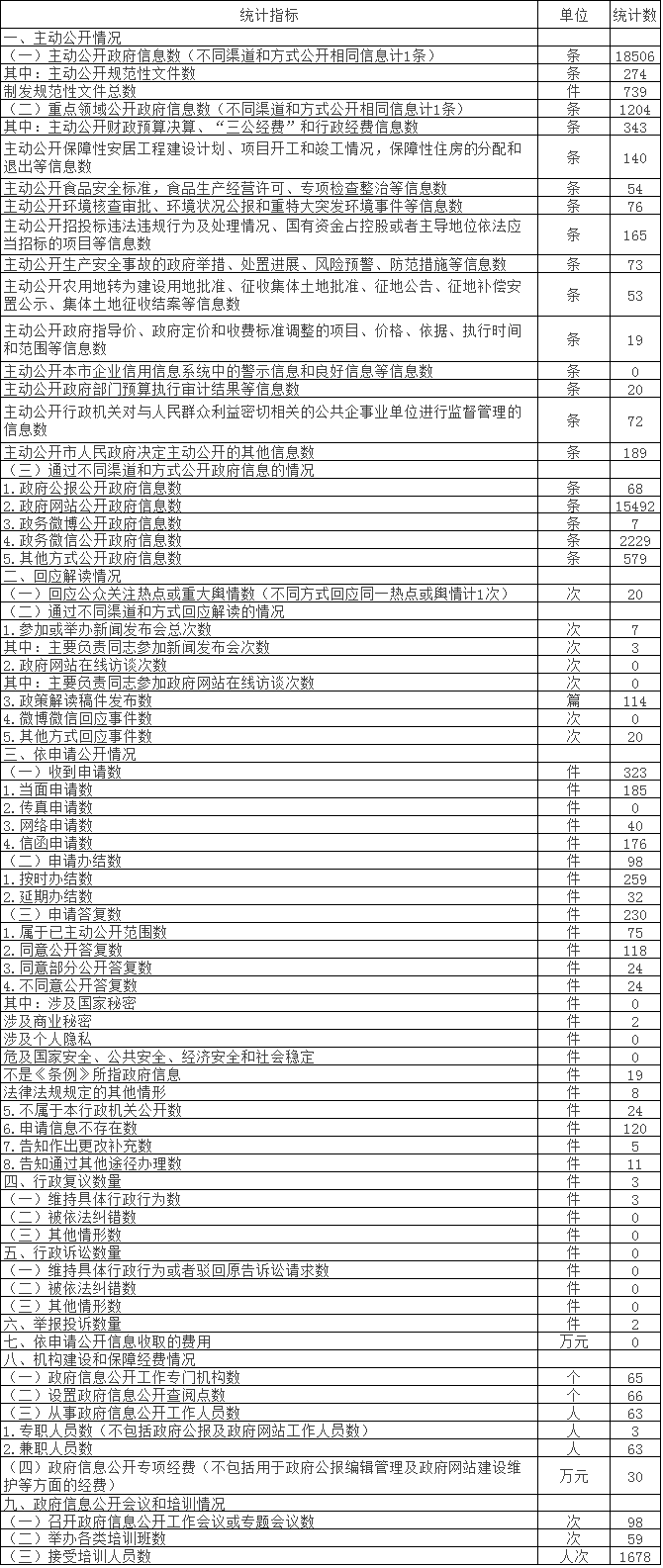

Second, information disclosure data

(a) take the initiative to disclose the situation

In 2018, the number of government information voluntarily disclosed was 18,506. 274 normative documents were voluntarily disclosed: 739 normative documents were issued. Number of open government information in key areas. Among them, the number of financial budget final accounts, "three public funds" and administrative funds information is 343; Take the initiative to disclose the construction plan of affordable housing project, the start and completion of the project, the distribution and withdrawal of affordable housing and other information 140; Take the initiative to disclose information such as food safety standards, food production and operation licenses, special inspections and rectification, etc. 54; The number of information such as environmental verification and approval, environmental status bulletin and major environmental emergencies is voluntarily disclosed; The number of information such as illegal bidding activities and their handling, the holding or leading position of state-owned funds, and the projects that should be tendered according to law 165; The number of government initiatives, disposal progress, risk early warning, preventive measures and other information about production safety accidents; Take the initiative to disclose information such as approval of agricultural land conversion to construction land, approval of collective land expropriation, announcement of land expropriation, announcement of compensation and resettlement for land expropriation, and settlement of collective land expropriation. The number of information such as the items, prices, basis, implementation time and scope of government-guided prices, government pricing and adjustment of charging standards; The number of information such as warning information and good information in the enterprise credit information system of this Municipality is 0; The number of information such as the audit results of government departments’ budget implementation is voluntarily disclosed 20; The number of information on the supervision and management of public enterprises and institutions closely related to the interests of the people by administrative organs is voluntarily disclosed;Voluntary disclosure of other information and other information decided by the Municipal People’s Government.

The disclosure of government information through different channels and ways, including the number of government information published in the government gazette 68; The number of government information published on government websites (including public columns) is 15492; The number of open government information in government affairs Weibo 7; The number of government information disclosed by government WeChat is 2229; Number of other ways to disclose government information 579.

(B) Response to concerns and policy interpretation

Number of hot spots responding to public concern 20. Including, the total number of times to participate in or hold press conferences 7 (the number of times the main responsible comrades participated in press conferences 3). The number of online interviews on the government website is 0 (the number of online interviews attended by leading comrades on the government website is 0). Number of policy interpretation manuscripts published 114; The number of Weibo WeChat response events is 0; Number of other response events 20.

(three) according to the application for disclosure.

1. Application status

The total number of applications in the whole region is 323 (excluding manubrium departments), including 219 in the district government departments and 104 in the towns and streets. Among the application methods, 185 applications were made in person, accounting for 55% of the total; 0 applications were made by fax, accounting for 0% of the total; 40 applications were submitted through the Internet, accounting for 3% of the total; 176 applications were made by letter, accounting for 42% of the total. (Because the same application can be filed in multiple ways, the sum of classified applications is greater than the total number of applications. )

2. Response

There were 323 applications in the whole region (excluding manubrium Department), 259 were answered on schedule and 32 were postponed.

Of the 323 applications that have been answered:

75 items "belong to the scope of voluntary disclosure", accounting for 24% of the total;

118 "consent to disclosure", accounting for 42% of the total;

24 "agreed to partial disclosure", accounting for 9% of the total;

24 items of "disapproval of disclosure": among them, 0 items involved in state secrets; Involving 2 business secrets; 0 items involving personal privacy; Endanger national security, public safety, economic security and social stability 0; 19 items of government information not referred to in the Regulations; 8 other circumstances stipulated by laws and regulations. (Because the same application involves more than two kinds of "disapproval" disclosure situations, the sum of classification is greater than the total. )

24 items "not disclosed by this administrative organ", accounting for 8% of the total;

120 "application information does not exist", accounting for 44% of the total;

"Inform to make changes and supplements" 5 items, accounting for 2% of the total;

There are 11 cases of "informing through other channels", accounting for 4% of the total.

3 according to the application of public government information charges.

In accordance with the requirements of the Notice of the Municipal Finance Bureau and the Municipal Development and Reform Commission on Cleaning up and Regulating a Batch of Relevant Policies for Administrative Charges (Jing Cai Zong [2017] No.569), since April 1, 2017, the city has stopped charging fees for the disclosure of government information upon application. From January 1, 2018 to December 31, 2018, our district did not charge for the disclosure of government information upon application.

(four) administrative reconsideration, litigation and reporting.

1. Administrative reconsideration

Three administrative reconsideration cases caused by the disclosure of government information by administrative organs in the whole region all maintained the government information disclosure reply made by administrative organs.

2. Administrative litigation

There are no administrative litigation cases caused by the disclosure of government information in all administrative organs in the region.

Step 3 report

The district government information disclosure office received two reports related to government information disclosure, which were verified to be inaccurate.

(5) Institution building and security training.

The number of specialized institutions for information disclosure in the local government is 65, and the number of access points for government information disclosure is 66; 66 staff engaged in government information disclosure, including 3 full-time staff; Number of part-time employees 63; The special fund for government information disclosure is 300,000 yuan; The number of government information disclosure work conferences or special conferences held in the whole region is 98; Number of training courses held 59; The number of people trained is 1678.

Third, the existing shortcomings

Looking back on the work of the whole year, great progress has been made, but according to the new situation and new tasks, combined with the reality of Miyun, there are still some shortcomings in the information and government affairs disclosure work of our district government.

First, there is still a gap between the overall promotion of government affairs openness and the concerns and needs of society and the people. According to the work objective of the Implementation Opinions of the General Office of the Beijing Municipal Committee of the Communist Party of China and the General Office of the Beijing Municipal People’s Government, there is still a lot of work to be done in our district. Deepening the content of government affairs disclosure, strengthening the voice of the government, expanding public participation, institutionalization, standardization and information construction of government affairs disclosure need to be continuously promoted, and there is still a certain distance from realizing the realization of public content covering the whole process of power operation and government services.

Second, there is still a gap between the requirements of open work according to application and administration according to law and the needs of the public. The People’s Republic of China (PRC) Municipal Government Information Disclosure Ordinance is being revised, and the newly revised Ordinance will make up for many shortcomings of the current Ordinance. However, many difficulties in application-based work will persist for a long time. How to fully implement the revised Ordinance, continuously improve the mechanism of application-based disclosure, improve the quality of the disclosure team, and reduce administrative reconsideration and administrative litigation caused by information disclosure needs further research and exploration.

Fourth, the next step

In-depth study and implementation of the spirit of the 19th National Congress of the Communist Party of China, guided by Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era, and in accordance with the requirements of building a government ruled by law, an innovative government, a clean government and a service-oriented government, we will comprehensively promote the information and government affairs disclosure work of our district government.

(a) to further standardize the disclosure according to the application and improve the level of administration according to law. Continue to strengthen education and training, enhance the understanding of application-based work at all levels, and further standardize the three links of public acceptance, handling and reply according to applications. Strengthen administration according to law, invest more efforts to deal with the difficult problems of application, minimize the occurrence of administrative reconsideration and litigation cases, and avoid the situation that the decision on application is revoked or even lost. At the same time, in accordance with the overall deployment of the Municipal Affairs Service Bureau, make preparations for the implementation of the revised Regulations.

(two) to realize the intensive construction of government websites and improve the convenient and orderly service function.

In 2019, the 82 tasks listed in the Implementation Opinions of the General Office of the Beijing Municipal People’s Government on Implementing the Guidelines for the Development of Government Websites (Beijing Zhengban Fa [2017] No.51) will be fully and continuously implemented, and the website survey, investigation, standardized and intensive integration, docking and other work will be done well. By the end of August 2019, the integrated website of the district government will be revised and launched. As the website authority, the district government office is responsible for the overall planning, supervision and assessment, assessment and supervision and accountability of government websites. Accelerate the integration and sharing of information resources, so as to make the website opening and integration more standardized and orderly, the service function more perfect and convenient, the information data more intensive and open, the security protection more stable and reliable, and the guarantee mechanism more sound and powerful.

(two) to strengthen the interaction between the government and the people and public participation, and comprehensively carry out the opening of the meeting and the open day of government affairs. With the opening of the district government executive meeting as a template, the mayor’s office meeting and the director/director’s office meeting will be opened in all towns, streets and departments, gradually increasing the scope of citizens’ participation in government decision-making, increasing the interaction between the government and the people, and enhancing the credibility of the government. Expand public participation, on the basis of pilot work, carry out government affairs open day activities throughout the region, broaden the open field, innovate the open form, and make the open day an important platform for citizens to understand the government and communicate with the people.

Statistical table of government information disclosure

(2018)