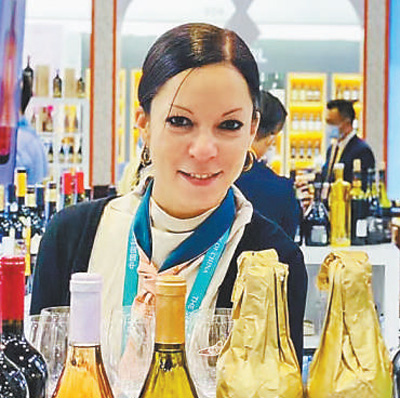

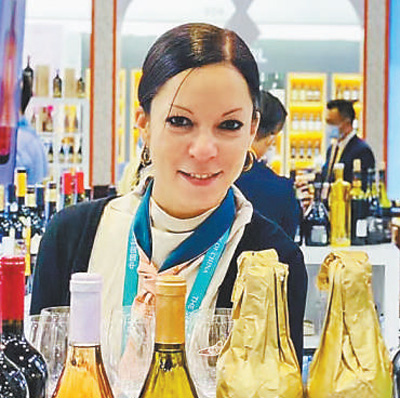

At the International Wine and Spirits Trade Exhibition held in Shanghai in 2020, Chen Xianni was promoting Ningxia wines. Information picture

Zhang Nuo (left) and grandma Zhang Kaizhi take a group photo in Xiaoyang Town. Photo by Cheng Shangzhi

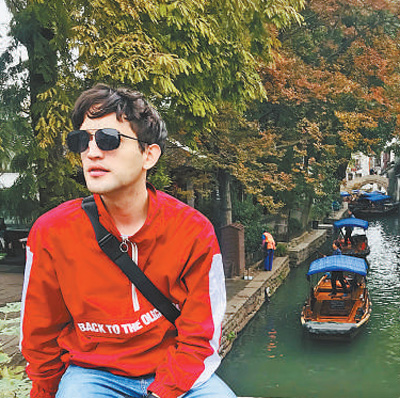

Gong Biyang felt the charm of Jiangnan water town in Suzhou. Information picture

In the vineyard of a winery located at the eastern foot of Helan Mountain in Ningxia, teachers and students of local universities are studying grape cultivation techniques. Xinhua news agency

Foreigners who have lived in China for a long time are witnessing the rapid development of China and feeling the real three-dimensional China. In their view, China’s development achievements today are the result of the Communist Party of China (CPC)’s unity and leadership of the people of China, and the happy life of the people of China is created by struggle.

Everyone is struggling and there are dreams everywhere.

Our reporter Wang Hanchao Qin Ruijie

Every morning, Chen Xianni drives from Yinchuan, and it takes about an hour to drive through the continuous vineyards to the winery where she works.

All the way along the eastern foot of Helan Mountain, the mountain is vast, and the foot of the mountain is a booming wine grape producing area. Chen Xianni remembers that in the past, after passing through this place, only the Yellow Sand and the Yellow River could be seen. Nowadays, it has become a "rare in the world" hot spot of wine industry, with a lot of wineries breaking ground and many people’s fate changed due to the rise of the industry. Planting and picking grapes in the wasteland, brewing wine, and then promoting good wine to the world. A French girl, Chen Xianni, witnessed the development of this cause from scratch.

It will become a new world-class wine producing area in the future.

Chen Xianni speaks fluent Chinese. She is not only the global brand ambassador of Xige Winery, but also a "bridge" for the outside world to understand this emerging wine producing area. Many visitors here have listened to her explanation, and through her, they know the great changes that have taken place in the local area.

Xige Winery is located at the southern end of Helan Mountain, behind which is the vast Tengger Desert in Inner Mongolia. The winery uses local materials, and uses nearly 200,000 pieces of Helan Mountain stones to form a ring-shaped tall wall, surrounding the entire brewing plant. Among them, there are many brewing tanks, wine storage space with constant temperature and humidity, closed management assembly line, a small library, a courtyard and a terrace overlooking the lake and vineyards.

Who would have thought that when Chen Xianni first came here, she only looked up at a wasteland. The mountain is bald, the land is light, and it goes without saying that the local people are poor. Zhang Yanzhi, the boss who invited her to join the entrepreneurial team, also lives in the board house on the construction site and eats sand all day long.

Chen Xianni’s hometown is located in the ancient wine producing area of France — — Burgundy producing area. She studied Chinese in France in college, and came to China in 2011. She first studied in Sichuan University, then worked in Wuhan and Shenzhen, and introduced wines from famous producing areas in France and other countries to China. Recalling the working environment at that time, Chen Xianni joked that it was "very elegant and glamorous".

Zhang Yanzhi, founder of Xige Winery, graduated from Bordeaux Wine School in France. When Chen Xianni got to know him, the other party was already a senior wine dealer. Therefore, at first, I heard that Zhang Yanzhi plunged into the northwest of China to start a business and took out a lot of money to build a winery. Chen Xianni was full of doubts.

"The most attractive thing about China is that there are dreams everywhere." As soon as Chen Xianni knew it, Ningxia would become a new world-class wine producing area in the future: the geographical latitude is moderate, the soil at the foot of Helan Mountain is rich in minerals, and the gravel soil is suitable for growing high-quality wine grapes; Abundant sunshine and convenient water control irrigation; The area is one hour’s drive from Yinchuan, and the regional location is unique … …

Zhang Yanzhi asked her: "There are many mature producing areas in the world, but can you find a second wine region that has participated in the construction from scratch?" Chen Xianni was moved.

Feel the great potential of the China market and witness how the dream becomes a reality.

The enthusiasm of China’s entrepreneurial team infected Chen Xianni, who is familiar with the wine industry. She was very excited to devote herself to the construction of Ningxia wine producing area. "I like China. This is a good entrepreneurial opportunity, and I don’t want to miss it. " In this way, she came to Ningxia with all her belongings in China.

Qingtongxia City, where the winery is located, belongs to wuzhong, Ningxia. When Chen Xianni first arrived here, the winery construction had just started, and she directly lived in the "Zhuangli". During the planting and picking period, she was busy with the workers in the vineyard; In the brewing stage, she communicated with the masters in the workshop; In the promotion season, she traveled all over the country on business. Sometimes, the winemaker is still working overtime until midnight, and she follows behind to taste samples and give advice.

Under the guidance of local industrial policies, entrepreneurs have been down-to-earth and worked hard, and the wine industry has gradually developed. Many local farmers, including some former poor households, have found jobs in wineries, increased their income and got rid of poverty, and their lives are getting better and better. Some young people from colleges and universities have joined the winery team after graduation, and many new ideas and ideas are constantly emerging. The production area at the eastern foot of Helan Mountain is gradually known to people in the wine industry at home and abroad. In 2019, the wines produced by Xige Winery were included in the purchase order by the representative restaurant of the United Nations Headquarters, and many categories opened up the domestic and international markets. At the 9th Ningxia Helan East Foothill International Wine Expo held in 2020, Helan East Foothill was awarded the title of "Top Ten Most Potential Wine Tourism Areas in the World" together with French Lu Valmont Louis and Spanish Priorato.

"The world of wine, like the world of Chinese, is getting richer as you learn." During her 10 years in China, Chen Xianni first brought foreign wines to China, and then introduced Chinese wines to the world. Watching the booming wine producing areas in China, she deeply felt the great potential of the China market and witnessed how her dream came true.

An industry brings 120 thousand jobs here every year

Affected by the epidemic last year, Chen Xianni, who was in France, could not return to China immediately. In her own words, she was "trapped" in her hometown for eight months. China’s colleagues and friends are calling and sending WeChat messages to care about her. When she finally had the opportunity to return to China, she immediately told everyone in the circle of friends: "I am back!"

"Returning to Ningxia is like returning home. This feeling is too strong." Chen Xianni said that she likes the development speed of China and is used to the pace of life here. "There is always one thing after another waiting to be done." People are fighting for a better life. "In China, this is a state shared by many people around me."

She returned to Ningxia and saw her colleagues brewing a new flavor of wine. Snake Dragon Ball is a wine grape variety with China characteristics. At first, people thought it was a miscellaneous fruit in the vineyard, but I didn’t expect the wine to give you the biggest surprise. "Its taste is balanced and soft, and it can especially express the characteristics of Ningxia. We hope to make it a wine that can express the characteristics of China. " Chen Xianni said.

During her stay in the winery, Chen Xianni often chats with the staff here. Ma Chengjun is one of many employees of the winery and vineyard who immigrated from Xihaigu. He is a native of Xiji County, Guyuan City. He left his hometown and came to the winery. He first learned to drive a tractor and later became the technical backbone of the vineyard. Today, Ma Chengjun is a director, managing more than 600 acres of vineyards, more than 20 workers, and taking the whole family to live in Suining Town near the winery.

When he is not busy, Ma Chengjun will tell Chen Xianni the story of his previous stay in Xihaigu and tell him that he walked several kilometers of mountain roads in order to drink clean water. Chen Xianni listened to the story of the past and looked at the changes of Ma Chengjun now, feeling deeply.

"People work, harvest, work again, and have bigger dreams ahead." Chen Xianni said that an industry brings 120,000 jobs here every year. Many people have a better life because of this. "A good life is created in this way. This is what I see in China."

Spread more real and vivid stories about China.

Our reporter Zhang Danhua

"This year marks the 100th anniversary of the founding of the Communist Party of China (CPC). The Chairman of the Supreme Leader wrote back to the overseas students in Peking University, encouraging them to know more about the real China, introducing their ideas and experiences to more people, and playing an active role in promoting the common feelings of people from all countries. As an international student, I am deeply inspired and encouraged. " Zhang Nuo, an international student from Kazakhstan, said.

Zhang Nuo is 29 years old. In September 2017, he came to Northwest A&F University to pursue a doctorate. Now he is a doctoral student in preventive veterinary medicine at Animal Medical College. She likes her life in China very much. In her words, it is "safe to travel, convenient to shop, full of special foods, and the modernization of the city is shocking".

Last June, Northwest A&F University organized overseas students to come to zhenba county, Shaanxi Province to carry out activities of supporting agriculture through science and technology, and Zhang Nuo participated in it. "I have been deeply impressed by China’s efforts in the fight against poverty, the great achievements made in China’s reform and opening up, and the earth-shaking changes in the countryside."

When Zhang Nuo and his classmates first arrived in Xiaoyang Town, zhenba county, the villagers had never seen foreigners on weekdays, and at first they were quite embarrassed. After getting along for a period of time, when they heard that Zhang Nuo could speak Chinese and understood the related techniques of raising sheep, they came to ask her "how to raise a good sheep".

"For the aquaculture industry, disease prevention and control is particularly important. If you wait until the sheep get sick and then treat them, if it is an infectious disease, it will cause a large number of sheep to die. " Zhang Nuo repeatedly introduced to the villagers the importance of disease prevention and the key points of prevention: first, environmental sanitation management, regular cleaning of sheep houses to ensure that sheep houses are clean and tidy; Second, do a good job of disinfection, kill pathogenic microorganisms remaining in the environment, and reduce the incidence of epidemics.

During her stay in Xiaoyang Town, 74-year-old grandma Zhang Kaizhi caught Zhang Nuo’s attention. "Grandma zhang looks like my own grandmother. Every time I see her, it always reminds me of my family in Kazakhstan. " In this way, Zhang Nuo had a grandmother from China.

After helping farmers, Zhang Nuo returned to school. Because of her grandmother China, she has always remembered this small town in the mountains. Three months later, she set off from school, and after several twists and turns, after seven hours’ journey, she came to Xiaoyang Town again. Different from before, this time Zhang Nuo went to the new home that Grandma Zhang just moved to.

The new home is at the foot of the mountain, which is a housing project house built with the help of the government. The room is spacious and beautiful. Grandma knew that Zhang Nuo was coming, so she cleaned the room in advance. They made lunch together, and after eating happily, grandma took her to the sheepfold by electric car to see the growth of the lamb.

According to Zhang Nuo’s guidance, grandma’s sheep are rarely sick now, and several new lambs have been added to the sheephouse. "The lambs are all growing well!" Grandma told her that, driven by the specialized agricultural and animal husbandry cooperatives, more than 20 poor households, whose lives were originally difficult, increased their income by more than 10,000 yuan every year, and everyone’s life became better and better. "It’s so comforting!" Zhang Nuo is very happy.

By this year, Zhang Nuo has been studying and living in China for four years, and her understanding of China is getting deeper and deeper. Nowadays, she often uploads her videos on social networking platforms, introduces China to Kazakh netizens and shares the places she has traveled in China. "Netizens are very interested." She also uploaded a photo and video with Grandma Zhang, telling that with the help of the China government, Grandma Zhang lived a happy and beautiful life, which attracted many praises from Kazakh netizens.

"China’s rapid development today is the result of the Communist Party of China (CPC)’s efforts to unite and lead the people of China. As an international student, I am honored to witness and participate in the rapid development of China. I hope to spread more real and vivid China stories to the world and let more foreigners know about China. " Zhang Nuo said.

China opens its mind to the world.

Our reporter Yao Mingfeng

"China is opening its mind to the world with an open attitude." Argentine Brian Gonzá lez, who has been studying in China for 10 years, said with emotion. Over the years, he has increasingly felt Chinese’s pride and confidence in local culture and respect and tolerance for foreign cultures. "A well-off society gains not only the victory of material civilization, but also the growth of spiritual civilization".

Compared with the name Bryan Gonzá lez, his Chinese name, "Gong Yang", is more familiar to TV viewers and netizens in China. Gong Biyang has been making short videos about the friendship between Albania and China and posting them on social networking platforms. In the video, he talked with Argentine friends about China in their eyes.

This year, he published an article in Argentine newspaper Clarion, sharing his story in China. In the article, Gong Biyang introduced the successful experience of China’s development to the Argentine people. He said that China has successfully eliminated absolute poverty and developed Socialism with Chinese characteristics’s market economy, and China’s development cannot be separated from the Communist Party of China (CPC)’s leadership.

Gong Biyang told reporters that he appreciates China not only because of the continuous innovation of science and technology and the convenience of life in China, but also because of the openness, tolerance and self-confidence shown by China people in their communication with foreigners. "China’s traditional culture is active in the present with a new form of expression." Gong Biyang noticed that there are more and more traditional elements in the daily life of young people in China, such as cultural and creative products, Beijing Opera-style restaurants and poetry-themed bars, which often attract many customers.

Gong Biyang knows a Hanfu lover in Chongqing. This girl not only often participates in various exhibitions in Hanfu made in the Tang Dynasty, but also designs Hanfu herself, runs stores, supports public welfare activities and cooperates with some museums and art galleries. Gong Biyang became attached to Hanfu and participated in some related activities. "Traditional culture has always played an important role in the social development of China, and there are many innovative presentations at present, which shows China’s increasingly strong cultural self-confidence."

In 2018, Gong Biyang went to Wuhan to experience Peking Opera performances. The teacher is a little girl under the age of 10. Her gestures, styles and smiles are just right, and her professionalism is amazing. Under the guidance of this little teacher, Gong Biyang learned the excerpts from the Beijing Opera "The Drunk Imperial concubine". He said with emotion: "The quintessence of China like Beijing Opera gives us the ability to feel beauty and gives people stronger spiritual strength."

"A nation with cultural self-confidence is willing to communicate with the world. China welcomes cultures from all over the world and is willing to learn more about different cultures. " Gong Biyang was deeply impressed by the Argentine tango performance at this year’s Spring Festival Evening of the Year of the Ox. Accompanied by the cheerful melody of the famous tango "Maria of Buenos Aires", dancers dressed in Argentine costumes sometimes encircle and rotate, and sometimes kick and jump, conveying the enthusiasm and vitality from Argentina to the audience. "Spring Festival Evening is a must for many Chinese Spring Festival ‘ New Year’s Eve ’ . At such an important moment, tango allows Argentine and China people to share the joy of the festival. " Gong Biyang said.

Gong Biyang, who is proficient in Chinese, uses "eclecticism" to describe the diversity and tolerance of China culture. He recalled a recording experience in China in 2016, in which he appeared in a cloak of Argentine gauchos. "How many kinds of cloaks are worn on different occasions? Put it on your head, put it on your shoulders, and tie it around your waist. Will the meaning be different? " The audience asked questions with curiosity. Gong Biyang didn’t expect that his cloak would arouse enthusiastic questioning from the audience in China. "They asked not only a cloak, but also the Argentine culture behind traditional costumes. I feel their strong interest in Argentine culture. " Gong Biyang said that he hopes that through his own efforts, "the cultural exchange between Afghanistan and China will go further."

People’s Daily (17th edition, November 22nd, 2021)