How to reset the password when the e-tax bureau has opened the password account but forgot it?

01

Q: The taxpayer’s electronic tax bureau has opened a password account, but I forgot how to reset the password.

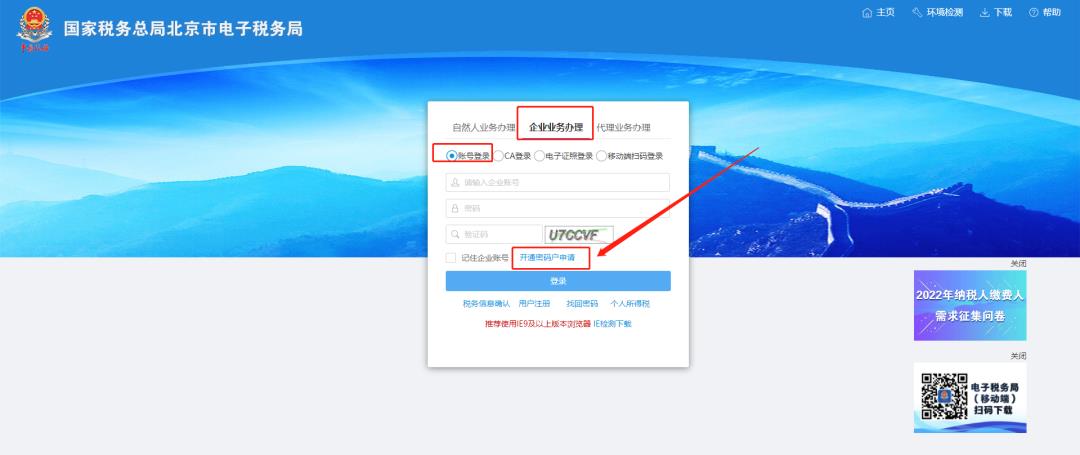

Answer: Please go to the login interface of the Electronic Taxation Bureau and click Enterprise Business Handling-Account Login. The account refers to the enterprise tax number. For the password, you can click "Open Password Account Application", fill in the information and submit the application. The tax authorities will send a password message to the legal representative.

The graphic guidelines are as follows

I. Login interface of electronic tax bureau-enterprise business processing-account login.

Second, the password can be clicked on "Open Password User Application".

Third, open the password account application page.

02

Q: Can I only go to the site to apply for a 10% increase in the previous application and need to correct the declaration?

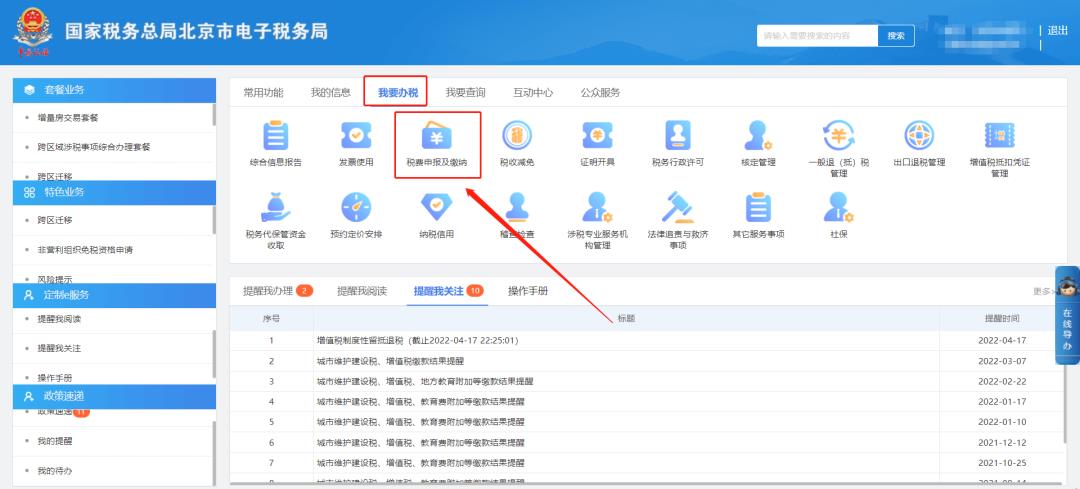

A: You can do it online. Please click I want to pay taxes-tax declaration and payment-correct previous declarations (value-added tax, consumption tax, withholding of value-added tax and withholding of enterprise income tax) to make corrections.

The graphic guidelines are as follows

I want to pay taxes-declaration and payment of taxes and fees.

II. Tax declaration and payment-page for correcting previous declarations (VAT, consumption tax, VAT withholding, enterprise income tax withholding).

03

Q: How to delete the ticket winner?

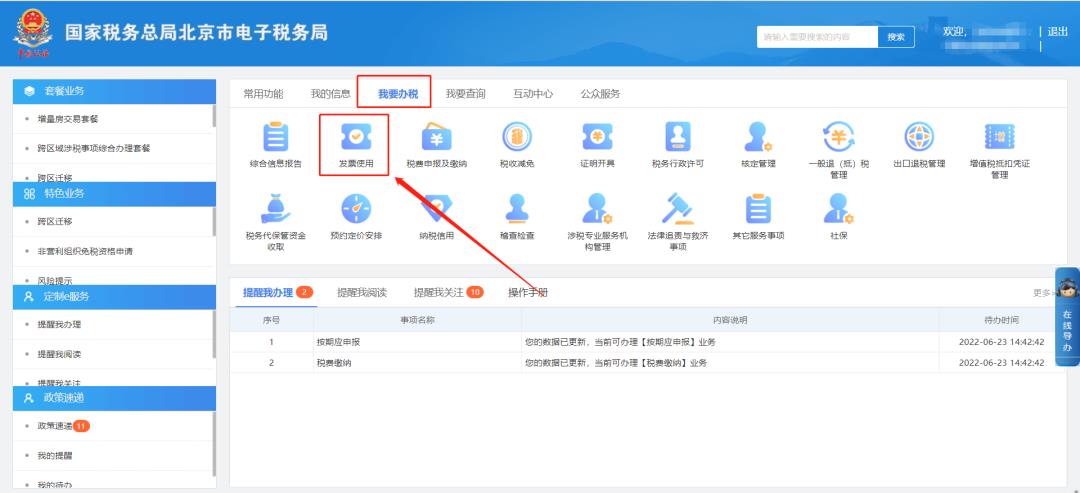

Answer: Please click My Information-Taxpayer Information-Real Name Tax Identity Information Collection Interface, click Cancel Association behind the ticket buyer or click Invoice Use-Invoice Type Verification-Invoice Manager Maintenance (Add or Change), and delete the ticket buyer after entering.

The graphic guidelines are as follows

Method one

First, my information-taxpayer information.

2. Taxpayer information-real name tax identity information collection interface, click Cancel Association behind the ticket buyer.

Method 2

I want to pay taxes-use invoices.

II. Invoice Use-Invoice Type Verification-Invoice Handler Maintenance (addition or change).

Third, the invoice manager maintenance (new, change) page.