In-depth report on semiconductor industry (chips and equipment materials in sub-fields)

I. Overview of the semiconductor industry

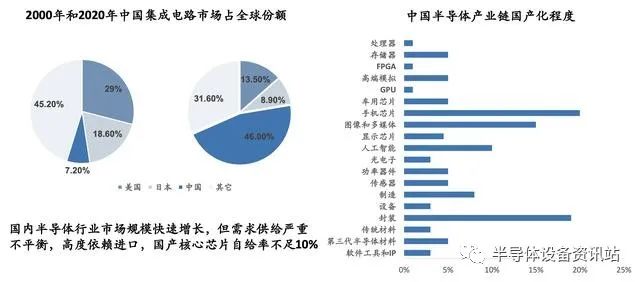

The market scale of domestic semiconductor industry is growing rapidly, but the demand supply is seriously unbalanced and highly dependent on imports. The self-sufficiency rate of domestic core chips is less than 10%.

In 2000 and 2020, China’s integrated circuit market accounted for the global share.

5G and AI technology

Science and technology innovation board has provided investment exit channels for hard technology enterprises, and the capital market has actively laid out hot tracks in science and technology innovation board including semiconductors.

Distribution of industries in science and technology innovation board

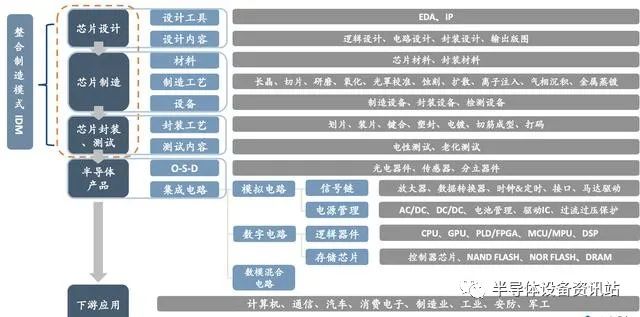

Second, the industrial chain structure of the semiconductor industry

Semiconductor industry chain

Third, the AI chip industry

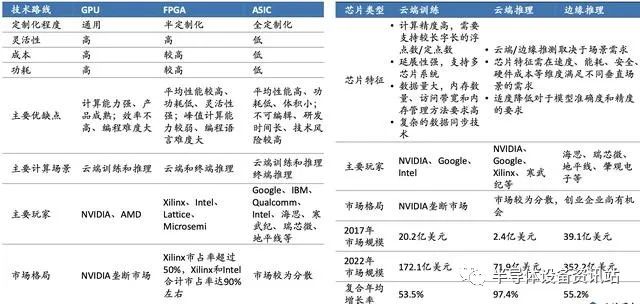

AI chip mainly includes three technical routes: GPU, FPGA and ASIC, which are divided into cloud training chip, cloud reasoning chip and edge reasoning chip.

AI chip downstream application

On the edge, AI chip mainly includes four application scenarios: Internet of Things, mobile Internet, intelligent security and autonomous driving.

AI chip downstream application

Fourth, 5G chips

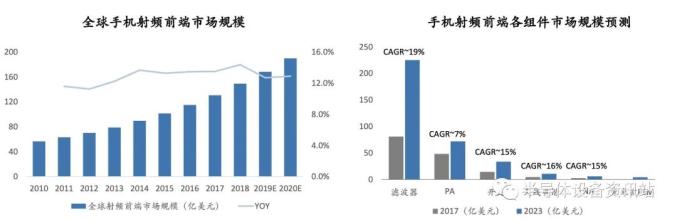

The market scale of mobile phone RF front-end chips is driven by the value growth of stand-alone RF chips.

Under the background of stable shipment of mobile terminal equipment, with the upgrade of communication network to 5G, the number and value of RF devices are increasing, and the market scale of RF front-end chip industry will continue to grow rapidly. From 2010 to 2018, the global RF front-end market scale will grow at an annual rate of about 13.10%, and it will be close to 19 billion US dollars by 2020.

RF front-end components have different growth rates. As the largest market segment of RF front-end, the market space of filters will increase from $8 billion in 2018 to $22.5 billion in 2023, with an annual growth rate of 19%, which is mainly due to the penetration of high-quality BAW filters. The market space of PA will increase from $5 billion to $7 billion, with an annual growth rate of 7%, mainly due to the growth of high-end and ultra-high frequency PA market, which will make up for the contraction of 2G/3G market.

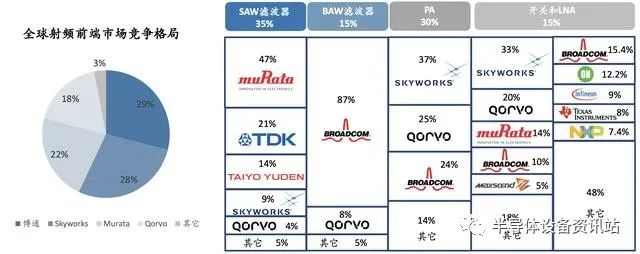

Competition pattern of global RF front-end chip market

At present, the market concentration of RF front-end is high, and foreign manufacturers occupy the vast majority of the market share. The domestic demand brought about by the trade war is the biggest opportunity for domestic RF manufacturers.

The integration of RF front-end makes future acquisitions and mergers and acquisitions an important means of capital withdrawal, and acquisitions and mergers and acquisitions are also one of the ways for chip companies to become bigger and stronger.

V. Internet of Things Chip

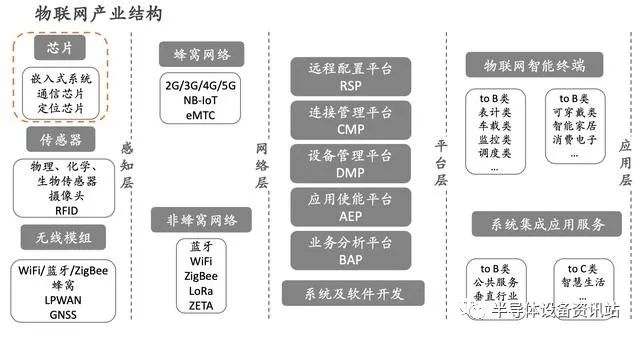

With the rapid development of the Internet of Things, the upstream industries related to its universality and connectivity are the first to benefit.

With the implementation of relevant communication standards and the development of communication and cloud computing technology, the Internet of Things has entered the growing period from the initial introduction period.

From the perspective of industrial chain transmission, the Internet of Things will change from "rapid networking" to "scale networking+application services", and the upstream industrial chain links with universality and connection with the Internet of Things will benefit first, including communication chips, sensors and wireless modules.

Industrial structure of internet of things

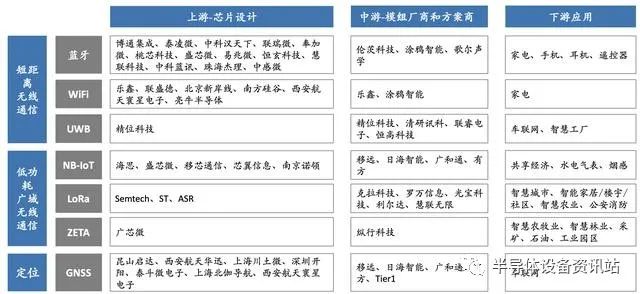

Atlas of Internet of Things Chip Industry

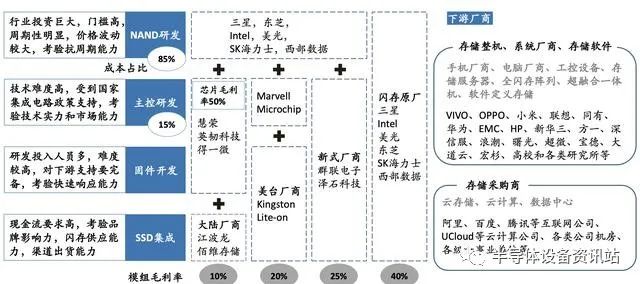

Sixth, the memory chip

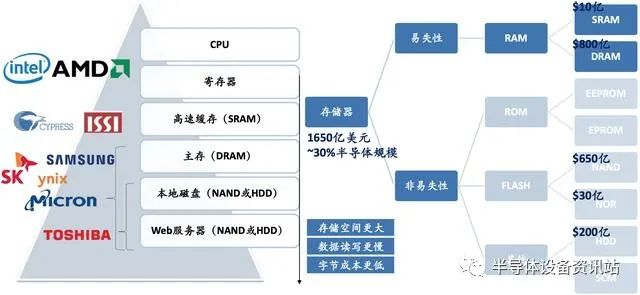

In 2018, the size of the memory market exceeded 160 billion US dollars, making it the largest field of semiconductors, accounting for 30%, and international giants occupied the market.

Atlas of memory chip industry

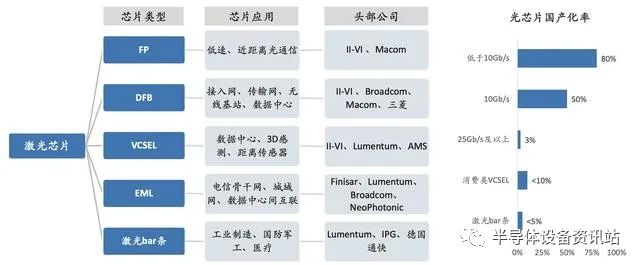

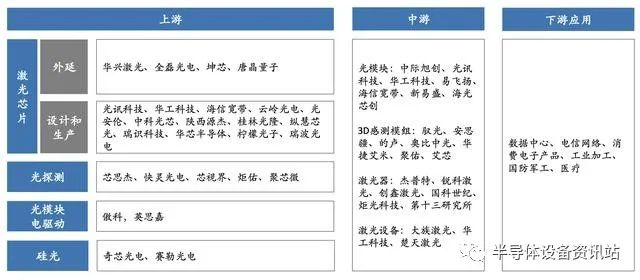

Seven, optical chip

The localization rate of high-speed optical chips is low, and almost all high-power laser chips depend on imports.

High-end (high-speed, high-power) optical chip industry has high barriers to entry, large investment, long cycle and great difficulty, especially chip material growth, chip design, chip manufacturing process and chip packaging are the core of optical chip R&D and manufacturing.

Atlas of optical chip industry

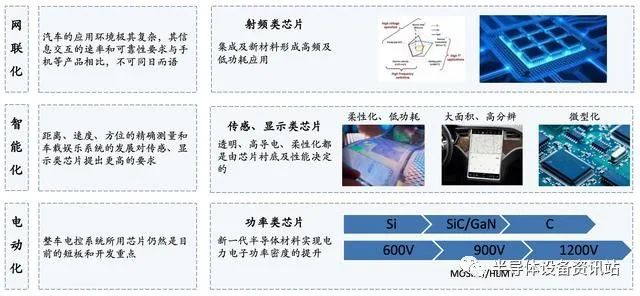

Eight, automotive chips

The development trend of automotive networking, intelligence and electrification promotes the development of automotive chips in the direction of high frequency, monolithic integration and low power consumption.

Nine, the third generation semiconductor

The third generation semiconductor materials have the properties of high voltage, high frequency and high temperature, and are widely used in the fields of photoelectricity, radio frequency and power.

The third generation semiconductor materials mainly include SiC, GaN, diamond, etc., and are also called wide band gap semiconductor materials because of their band gap width ≥2.3 eV. The third generation semiconductor materials have the advantages of high thermal conductivity, high breakdown field strength, high saturated electron drift rate and high bonding energy, which meet the new requirements of modern electronic technology for harsh conditions such as high temperature, high power, high voltage, high frequency and radiation resistance.

The construction of 5G base station promotes the rapid growth of GaN RF market.

Radio frequency device is the basic component of wireless communication equipment, which is responsible for the conversion, reception and transmission of electromagnetic signals and digital signals in wireless communication, and is the core of wireless connection.

In the past ten years, the application of national defense has been the main driving force to promote the development of GaN technology, and now these technologies are shifting from military to commercial. Due to their excellent high-frequency performance, most Hong Jizhan below Sub-6GHz will adopt GaN devices in the future, and 2019-2021 will be the key period for the construction of 5G infrastructure, and it will also be the key period for gallium nitride devices to replace LDMOS.

Atlas of the third generation semiconductor industry

X. MEMS chip

MEMS chip is the perception of a new generation of information technology

MEMS (Micro Electro Mechanical System) is an engineering technology that combines microelectronics and precision machinery. Its size is in the order of 1 micron to 100 microns, and it adopts the advanced manufacturing technology of integrated circuits. Compared with traditional products, MEMS has the advantages of miniaturization, high productivity, mass production and low cost.

MEMS technology is widely used in various sensor chips. Its core function is to convert physical signals into electrical signals that can be recognized by electronic devices. It is the perceptual basis and data source of the new generation of information technologies such as artificial intelligence, Internet of Things and big data. MEMS also has important applications in biology, optics, radio frequency, machinery and other fields.

The United States, Europe and Japan dominate the MEMS world, and the domestic MEMS industry is still in its infancy.

The layout of MEMS industrial chain in China is complete, but overall, the industry is still in the initial stage of development

The design and OEM links need to be strengthened. The OEM manufacturing is mainly based on 6-inch and 8-inch production lines, and the sealing and testing links have certain competitiveness.

There is a big gap between the products and foreign countries in terms of accuracy and sensitivity, and the application fields are moving from mobile phones and automobiles to VR/AR and Internet of Things.

Competition pattern of global MEMS market in 2018

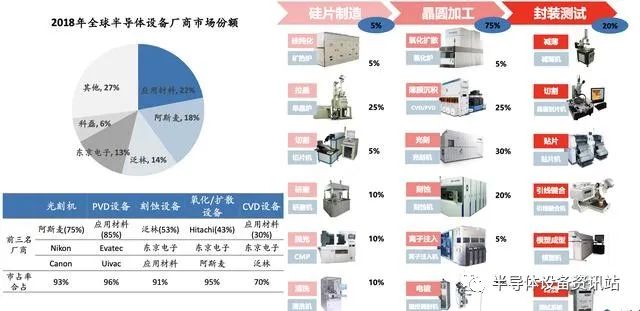

XI. Semiconductor Equipment

Wafer manufacturing is the link with the largest proportion of equipment, with lithography, etching and thin film deposition accounting for the largest proportion, and industry giants are concentrated.

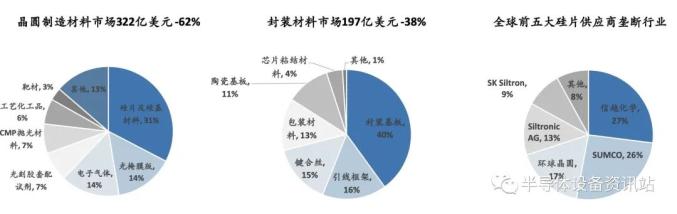

XII. Semiconductor materials

There are many market segments for wafer manufacturing and packaging materials, and the single market segment is small, and the industry giants are concentrated.

The market of semiconductor materials is more subdivided, the market space of single product is very small, and there are few pure semiconductor materials companies; Semiconductor materials are often only a small part of the business of some large material manufacturers, such as Dow Chemical Company, DuPont, Mitsubishi Chemical, Sumitomo Chemical, etc., and the semiconductor materials business is only a branch under its electronic materials business department; However, due to the strict requirements of semiconductor technology on materials, only a few suppliers can provide products for single semiconductor chemicals.

Silicon wafer giants are concentrated in Japan, South Korea, Germany and Taiwan, China; Only a few enterprises in Chinese mainland have the production capacity of 8-inch semiconductor wafers, while 12-inch semiconductor wafers mainly rely on imports.

The graphic system is reproduced on the Internet, and the copyright belongs to the original author. Does not represent Ben WeChat official account’s point of view. If copyright issues are involved, please contact us, and we will negotiate copyright issues or delete the content as soon as possible!

Original title: In-depth Report on Semiconductor Industry (Chip and Equipment Materials in Subdivision)