Cross-border e-commerce platform report, deeply dissecting 175 platforms around the world.

In the past 10 years, the cross-border e-commerce industry has triumphed all the way, and it has been tumbling on the snowy road of the tuyere dividend, which has made the whole industry prosperous..In the past year, the turning point of the industry came, and 2020 became the last gift of the cross-border old times. At this moment, cross-border e-commerce is entering a new era of "uncertain growth", an unknown era that attracts many sellers to find certainty in uncertainty.

In 2021, the growth of cross-border e-commerce industry seems to be in a bottleneck. On the one hand, the risk of instability of Amazon platform increases.,This year’s wave of titles has caused some China sellers who rely on Amazon to generate revenue to encounter large-scale store closures. The platform has developed from high-speed to high-quality development, and the policy has become stricter. On the other hand, the hot market has changed from incremental to stock.,The blue ocean market has gradually become popular, and the platform "price war" has further pushed the competition to white-hot. let alone,There are also a series of annoying problems such as Japan’s exchange rate diving, European tax reform, logistics congestion, and soaring freight rates.

Many sellers realize that it is better to spread risks than to put eggs in one basket..Instead of fighting in the red sea, it is better to find an incremental market.

The most important thing for "reducing risk and finding increment" is multi-platform layout and finding new markets. In the era of information explosion, blindly obtaining information is like looking for a needle in a haystack..If there is a comprehensive study on the global cross-border e-commerce platform,reportI believe that it will definitely give the seller guidance and traction to make more correct decisions.

ECCANG ERP combined with cross-border eye observationThe public data of major e-commerce platforms, major data websites and major research institutions around the world have been sorted out and analyzed for several months, and the "Research on the Competitive Situation and Opportunities of Global Cross-border E-commerce Platforms (2022)" was output.This is the platform and market report of the industry, and it is also the explosion of industry information launched by ECCANG ERP.report.

500 pages detailing 175 platforms and eight regions around the world.

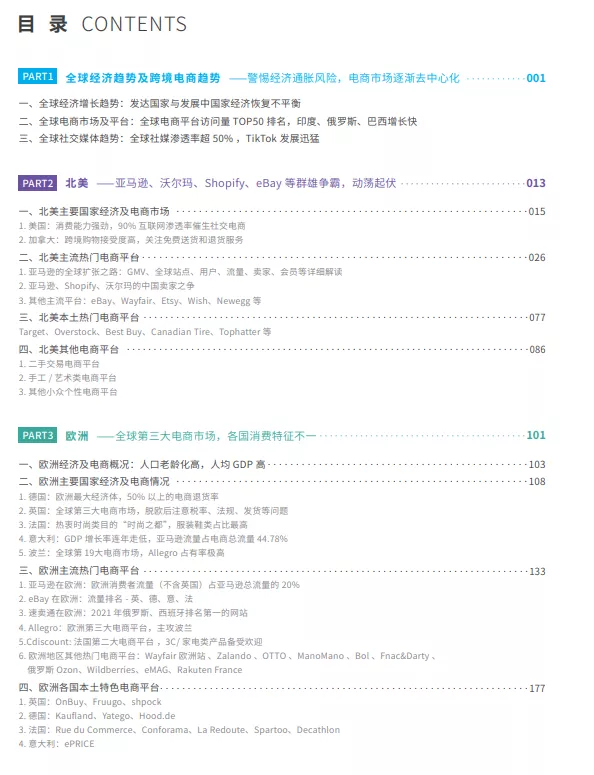

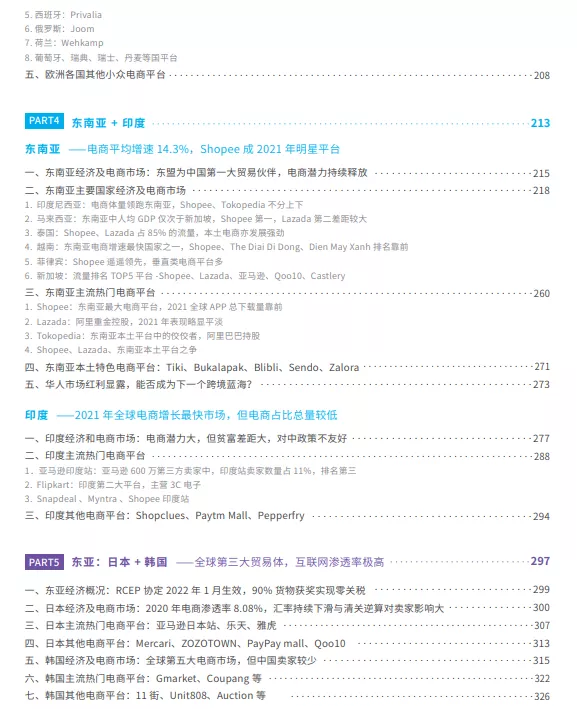

From the structural point of view,reportIt is divided into ten chapters, including the general situation of global e-commerce pattern and economic trend, and the research on various e-commerce platforms in eight markets: North America, Europe, Southeast Asia+India, East Asia, Latin America, Africa, Middle East and Oceania..specificThe catalogue is as follows.

Image source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022).

Judging from the content,Eccangerp-cross-border eye observation has dug deep into the opportunities and challenges of various regions and platforms in this region. Reference dimensionhaveThe current situation and development trend of local economy, the consumption will and level of local residents.、E-commerce penetration rate、E-commerce platform revenue, traffic, third-party sellers, promotion nodes, hot-selling categories, logistics, payment, investment policies, etc.

Image source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022).

Besides,reportAt the beginning, it makes a summary analysis of the global visits to TOP50 e-commerce websites. Starting from the seller’s actual business growth, this paper makes a horizontal and vertical comparative analysis of the platform opportunity points, and the seller can make a reasonable layout according to the platform potential and its own advantages.

It is worth mentioning that,reportThe research object of is not only the platform,It is also an e-commerce market research book.

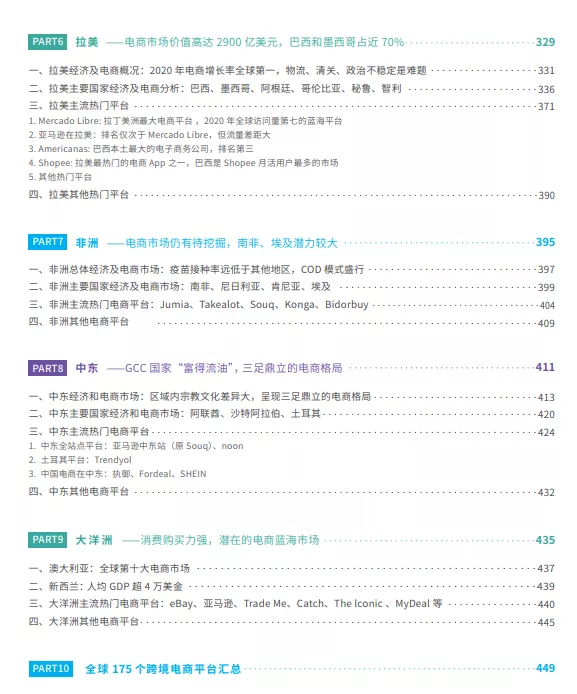

From the figure below, we can see that the top five countries in the global e-commerce sales growth forecast in 2021 are:India, Brazil, Russia, Argentina and Mexico.

(TOP10 countries that predict the fastest growth rate of global e-commerce in 2021)Image source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022).

Number one India, forecastexistE-commerce sales will increase by 27.0% this year. Brazil, Argentina and Mexico, as the major economies in Latin America, are ranked in the top, and their predicted sales growth rates all exceed 26%. Although these countries are growing rapidly, there is still huge room for growth compared with developed countries.

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),E-commerce sales growth and e-commerce penetration rate in the United States over the years)

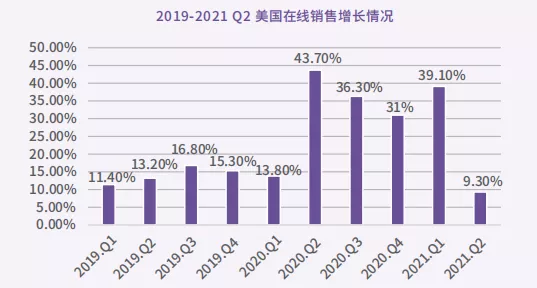

Take the United States as an example. In 2020, the total online consumption in the United States was US$ 861.12 billion, ranking second in the world, with a year-on-year increase of 44.0%, the highest in 20 years. In 2021, the growth rate of e-commerce in the United States slowed down, but the penetration rate of e-commerce is still increasing year by year, reaching 18.6% in the second quarter of 2021.

From these data, we can see the growth of e-commerce in various regions, but it is not recommended for sellers to enter these markets and expand blindly.In the market potential, the growth rate is not the only consideration, but also the epidemic situation, economy and infrastructure in the region should be considered.

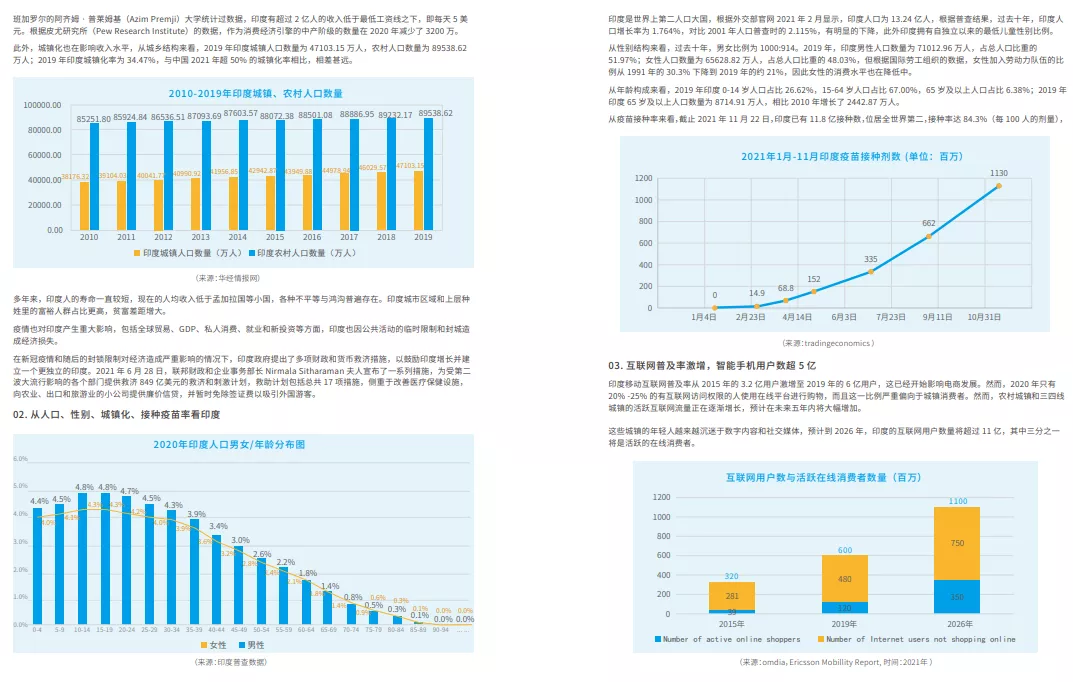

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),India’s economy and e-commerce market analysis)

Specifically, population, e-commerce penetration rate, consumer preferences, and regional e-commerce policies are the inevitable conditions for the development of e-commerce, and these factors are exactly the same.reportOne of the directions of analysis.

Situation analysis,Competition pattern of "one super and many strong"

reportThere is a more detailed division of 175 platforms, including popular platforms, local platforms and other minority platforms.

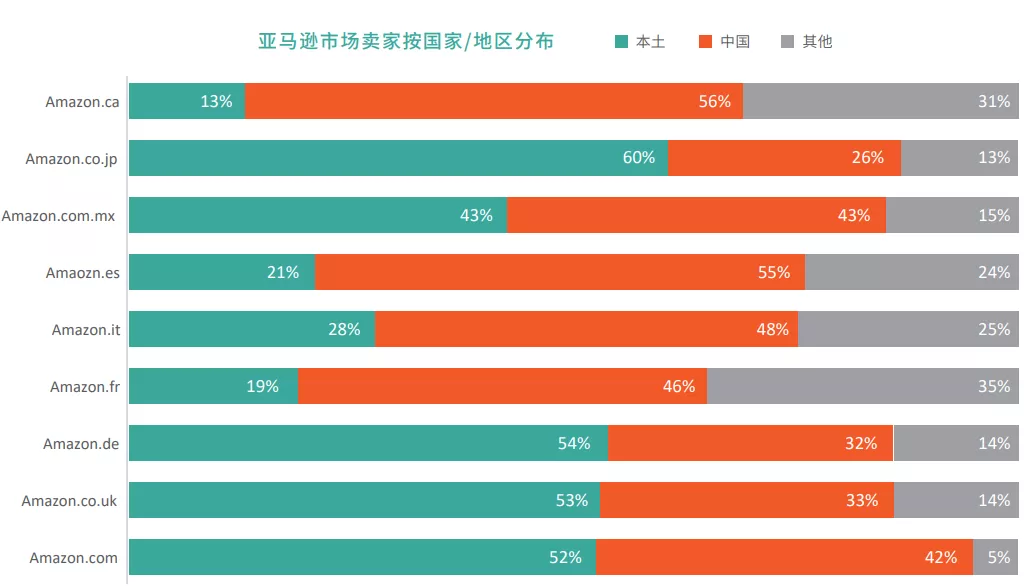

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),Amazon China sellers accounted for 2020)

As far as popular platforms are concerned, Amazon, as a leader, is also the most active platform for sellers in China.among. As shown in the above figure, among the nine Amazon websites in the world, the average proportion of sellers in China will exceed 42% in 2020. For example, in Amazon USA, China sellers account for 42%, Canadian sites account for 56% and Spanish sites account for 55%.

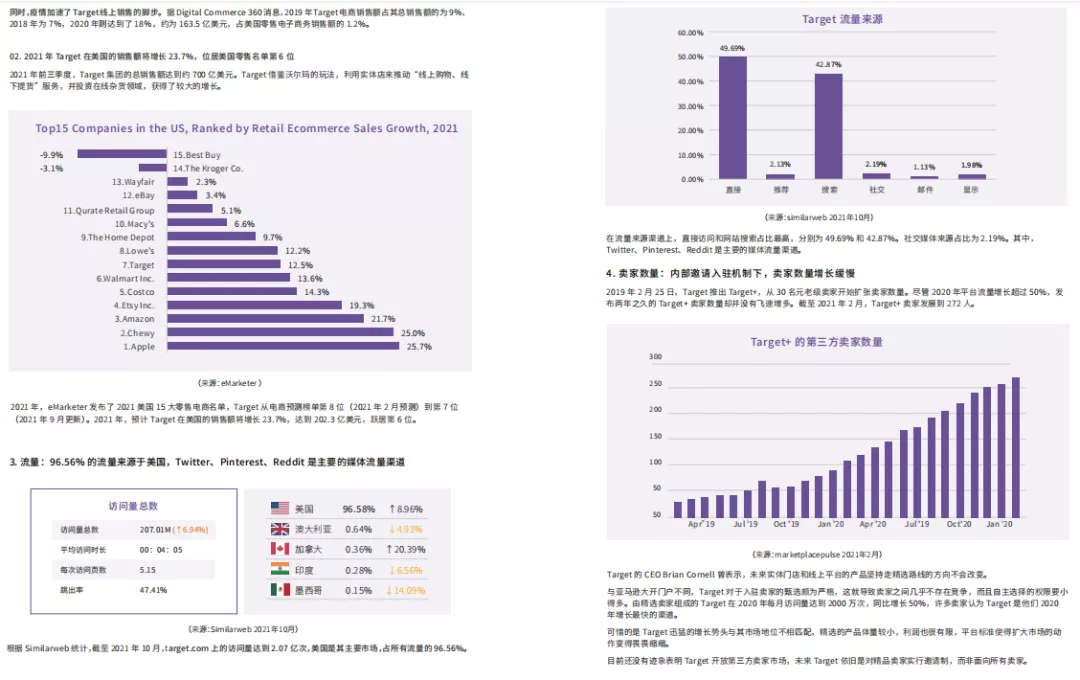

Affected by the decline in market demand this year, the growth rate of all major platforms has slowed down..However, Amazon is still in the position of "one super", and "how strong" is rising rapidly.

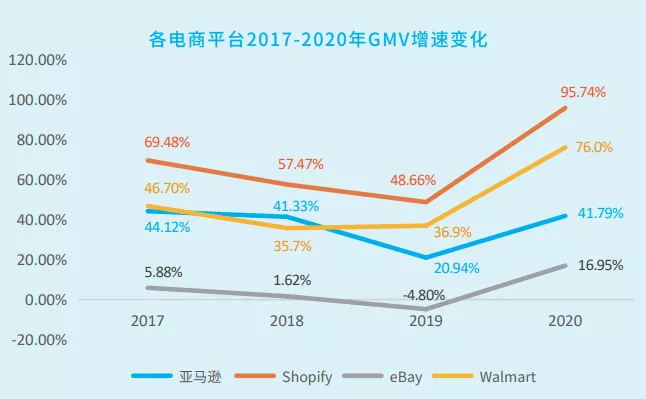

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),Changes in GMV growth rate of various e-commerce giants over the years)

As can be seen from the above figure, Shopify and Walmart have developed rapidly in recent years. In 2021, Walmart’s e-commerce revenue in the global market is expected to increase by 89%, far exceeding Amazon’s 16% increase. Shopify, as a website platform, once surpassed other competitors of Amazon, such as Walmart, Wish and Target, and became the choice of more and more sellers.

In addition to Shopify and Walmart, the strength of established e-commerce platforms such as AliExpress and eBay is particularly strong, and new strength platforms such as Lotte, Mercado libre, Allegro and Target are also rapidly grabbing market share.

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),Target platform analysis)

In the past, Amazon alone could achieve growth..now,The competition in the industry is intensifying, and the track is constantly shuffling. Sellers should keep a clearer head and keep up with the industry trends in order to maximize the benefits in the game of platform giants.

ECCANG ERP keeps up with the changes in the industry market.now,It has docked 60+ popular cross-border e-commerce platforms such as Amazon, Walmart, eBay, Shopify, Mercado libre, Allegro and Tik Tok.Help sellers manage multi-platform cross-border business efficiently, so that everyone can focus on researching and coping with industry changes.

Since the second half of this year, ECCANG ERP has launched new functions such as financial Kingdee docking, inventory 360, Walmart operation management, etc., based on the continuous iterative function of the seller’s actual business link.Help sellers improve operational efficiency, reduce inventory costs, prevent operational risks, and fully realize high-quality growth of cross-border e-commerce business.

Corner overtaking,Occupy the minds of local consumers

In recent years, Amazon has made frequent efforts in small European countries, Egypt and other markets, and Shopee announced the opening of the Polish market..However, the pace of giants exploring emerging markets is not always smooth.

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),Thai e-commerce platform TOP10;; Q3 2021)

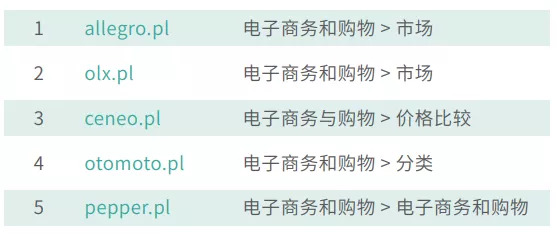

Among the popular e-commerce platforms in most countries in Southeast Asia, except Shopee and Lazada, there are no international e-commerce giants such as Amazon and eBay, but the development of local e-commerce is even stronger.In the Polish market, many cross-border e-commerce platforms have suffered setbacks..From April to May this year, the number of users of AliExpress Poland station dropped by 12.4%, and Amazon has never been on the list.

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),Polish e-commerce visits TOP5;; 2021)

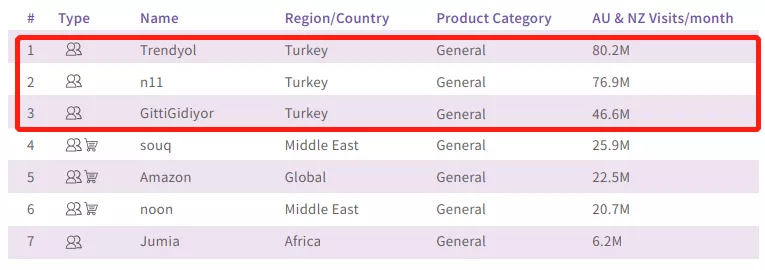

This is because,Compared with cross-border platforms, consumers in some regions trust local e-commerce platforms more.For example, Poland’s domestic e-commerce occupies a very large market share, Allegro’s awareness in Poland reaches 98%, and 96.22% of the platform’s traffic comes from the country.,Germans prefer to shop on websites with de. domain names.,The top three most visited platforms in the Middle East are all from Turkey (Trendyol, n11, GittiGidiyor).

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),Top 7 visits to the Middle East e-commerce platform; 2021)

It cannot be ignored that in recent years, local platforms in many countries are also opening to international sellers..For sellers who want to expand, these platforms have fewer sellers and less competition, so they should not be missed.

Rare platform,Nugget track for sellers of featured categories

In recent years, a large number of niche platforms have mushroomed.

The first is the original manual platform.In 2005, a social fashion appeared in the United States, which opposed excessive consumption and production and was proud of buying and using handmade products. cutstopIn 2020, the value of North American handicrafts market will be about 242.4 billion US dollars. In addition to the well-known Etsy, ArtFire, Aftcra, Zibbet, etc. have also entered people’s field of vision.

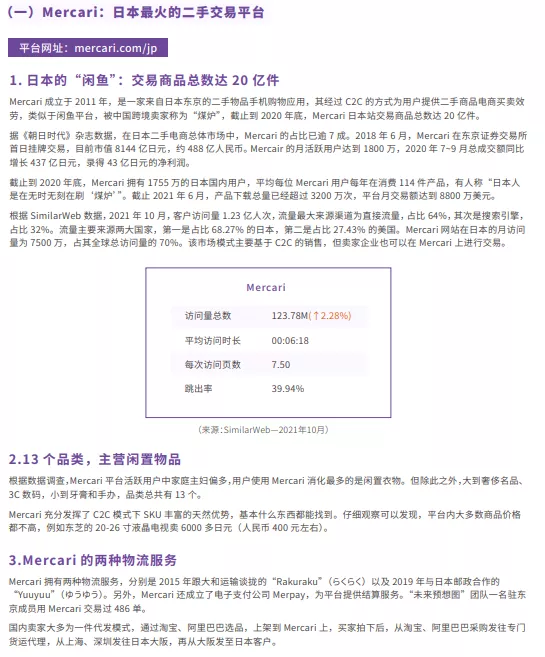

Followed by the second-hand platform.Affected by the epidemic, the United States set off a "wave" of second-hand consumption. take for example,Poshmark, the largest e-commerce platform for second-hand transactions in the United States, Grailed, a second-hand platform for men’s wear, Mercari, a second-hand trading platform in Japan, etc.

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),Mercari platform introduction)

In addition, there are some niche personalized e-commerce platforms.Such as collectibles, musical instruments, textbooks and other e-commerce platforms,It has also gradually opened up channels for international sellers to settle in, providing opportunities for sellers of related categories.

Which sellers can’t miss it? Reduce risk, enter the market newly, and find increment.

suchofInformation-richreportWhat types of sellers are suitable for?

First,Sellers who want to operate on multiple platforms and spread risks.In 2021, Amazon’s cleaning activities against illegal sellers made many sellers suffer greatly, making them realize that the greater their dependence on the platform, the uncertain risks they faced.Will be bigger..Many middle and tail sellers began to spill over from Amazon platform to other platforms in order to develop steadily.

Second,Looking for new sellers and new sellers.According to Marketplace Pulse data, from January to March, 2021, Amazon added 295,000 new sellers worldwide. In Amazon’s four core markets (the United States, Britain, Germany and Japan), on average, 75% of the new sellers came from China.

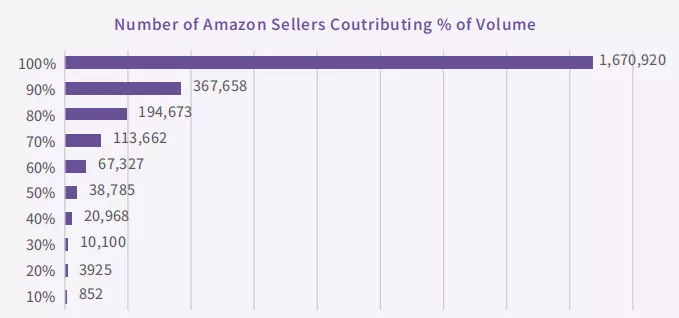

(Source: Marketplace Pulse 2020.,Number of Amazon sellers & proportion of sales contribution,Image source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022).

The number of sellers is increasing, and the competition is gradually intensifying. In 2020, 90% of Amazon’s global sales will be contributed by more than 360,000 head sellers. 60% is contributed by more than 60,000 head sellers. In other words, most GMV on Amazon platform comes from old sellers.This means that middle and tail sellers and new sellers must find new growth points if they want to enter Amazon, and exploring new blue ocean markets and platforms is an effective way.

Track summary, win at the starting line,Summary of 175 platform websites

In order to facilitate quick positioning, 175 platform websites are included at the end of this book. Some screenshots are attached here..

(Source:Research on Global Cross-border E-commerce Platform Competition Situation and Opportunities (2022),175 platform websites, part)

Due to the limited space, the above is a partial introduction to "Research on Competition Situation and Opportunities of Global Cross-border E-commerce Platforms (2022)", accounting for only.reportThe tip of the iceberg, please check out more exciting content.Genuine.

About ECCANG ERP

ECCANG ERP, as a one-stop cross-border e-commerce management system under Shenzhen Yicang Technology Co., Ltd., has been connected with 60+ cross-border mainstream platforms such as Amazon, Walmart, Shopee and Shopify, and can provide refined and digital management of cross-border whole processes such as procurement, sales, inventory, logistics and finance. At present, it has served 100+billion-level selling users and 30,000+growing seller users, effectively helping China enterprises to go to sea!

(Editor: Jiang Tong)

(Source: Yicang)

The above content only represents the author’s own point of view, not Hugo’s cross-border position! If you have any questions about the content, copyright or other issues, please get in touch with Hugo within 30 days after the publication of the work.